Mortgage Calculator

The most advanced free mortgage calculator.

Estimate payments, taxes, insurance, and PMI.

Amortization

See every payment breakdown.

Principal vs interest, month by month.

Mortgage Payoff

Pay off your home faster.

See how extra payments save you money.

Refinance

Should you refinance?

Compare rates and calculate your break-even point.

Rent vs Buy

Which is right for you?

Compare the true cost of renting vs owning.

VA Mortgage

Built for veterans.

Calculate VA loan payments with funding fees.

State-Specific Calculators

Calculators tailored for local taxes, fees, and programs.

California Mortgage

Navigate the Golden State.

Mello-Roos, Prop 13 taxes, and FAIR Plan insurance.

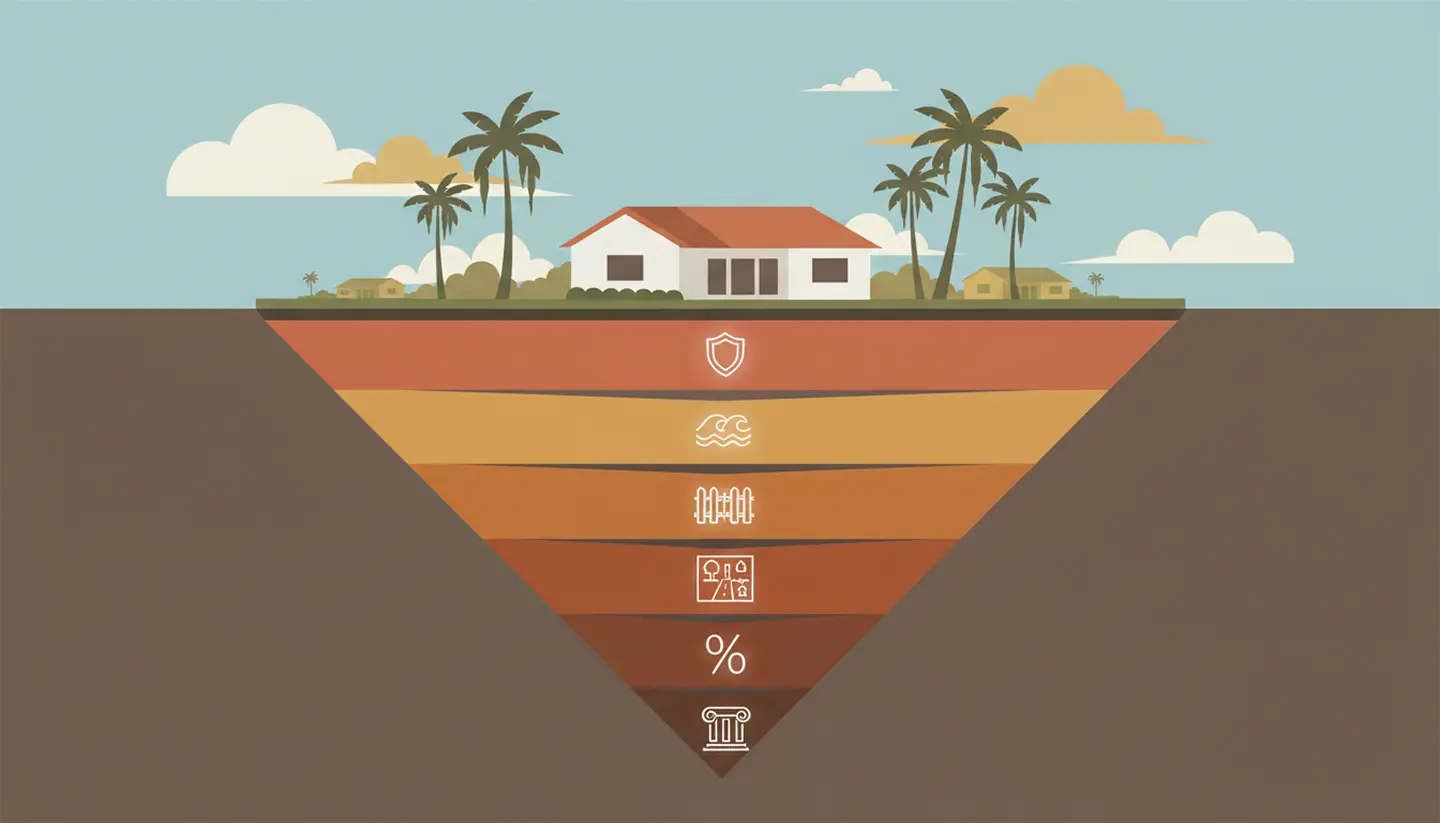

Florida Mortgage

The Sunshine State's true costs.

Insurance crisis, flood zones, and CDD fees included.

Texas Mortgage

Built for the Lone Star State.

Property taxes, MUD districts, and homestead exemptions.

Texas MUD Tax

The hidden cost of new homes.

Calculate MUD taxes before you buy in Houston or Austin.

Interactive Tools

Smart tools to help you find the right programs and make better decisions.

Free Homebuyer Resources

Guides, downloads, and smart housing tips to help you plan, qualify, and save.

Market Insights

Expert analysis and guides to help you make informed decisions.

California First-Time Homebuyer Programs

100+ programs with up to $500K in combined assistance. State, local, federal & private.

CalHFA Down Payment Assistance

Up to $150,000 for California first-time buyers through Dream For All and MyHome.

27 Housing Hacks:

Rent, Buy, or Pay Off Faster

27 proven tactics with real numbers and calculators to prove it.

Housing Data Tools Compared

Zillow vs HouseCanary vs CalcLogix—which tool fits your workflow?

Texas First-Time Homebuyer Programs

75+ programs offering up to $125,000 in down payment assistance.

How to Stack Texas DPA Programs

Turn $15,000 in assistance into $50,000+ by combining the right programs.

How Amortization Works

Why 85% of your early payments go to interest—and what you can do about it.

Mortgage Rates Guide

How rates are determined and strategies to secure the best one.

Housing Inventory Trends

2025 Year-End Recap & 2026 Forecast