Quick Answer

The short answer: California has 100+ assistance programs that can be stacked to cover your entire down payment and closing costs.

The 3 most important programs to know:

- Dream For All: Up to $150,000 (shared appreciation loan, lottery-based)

- MyHome: Covers 3–3.5% of your down payment (deferred loan, generally available)

- Local DPA: Programs like SF DALP offer up to $500,000 in high-cost counties

The strategy: Most buyers combine a CalHFA first mortgage with MyHome assistance to buy with almost zero cash out of pocket.

Key Takeaways

- Dream For All: $150K max, lottery-based, opens early 2026

- MyHome: 3–3.5% deferred loan, generally available year-round

- Local programs: $10K–$500K depending on your county

- Federal: FHA (3.5% down), VA (0% down), USDA (0% down rural)

- Income limits: $185K (Fresno) to $325K (San Francisco)

- Stacking potential: $50K–$500K+ by layering multiple programs

- Required: 8-hour homebuyer education ($100) for all programs

What's in This Guide

- State Programs (CalHFA)

- Dream For All ($150K)

- MyHome Assistance (3.5%)

- 2026 Income Limits by County

- Southern California Programs

- Bay Area Programs

- Central & Northern CA Programs

- Federal Loan Programs

- Bank Grants & Credit Unions

- Program Stacking Strategies

- How to Apply (Step-by-Step)

- Best Programs by Situation

- Frequently Asked Questions

California's median home price is $823,000.

A 20% down payment? That's $165,000 in cash. Even 3% down requires $25,000.

Here's what most people don't know:

California has more homebuyer assistance than any other state—over 100 programs across state, local, federal, and private sources.

Buyers who know how to navigate this system can access $50,000 to $500,000+ in combined assistance. Some walk away from closing having paid almost nothing out of pocket.

The problem?

These programs are fragmented across dozens of agencies. Different eligibility requirements. Different funding cycles. Different application processes. Nobody tells you which ones to combine.

That's what this guide fixes.

We've compiled every major California first-time homebuyer program into one database—with verified income limits, current availability, and the exact stacking combinations that minimize your out-of-pocket costs.

California Homebuyer Assistance by the Numbers

- 100+ programs across state, local, federal, and private sources

- $500,000+ maximum combined assistance (SF area)

- $325,000 highest income limit (San Francisco/Santa Clara)

- 233,000+ families helped by CalHFA since 1975

- $43.5 billion invested by CalHFA in California homeownership

Part I: State Programs (CalHFA)

What Is CalHFA?

Think of CalHFA as California's "bank for first-time buyers."

They don't lend you the money directly (you still go through a regular lender). Instead, they provide the extra cash you need for the down payment and closing costs.

Since 1975, they've helped over 233,000 families buy homes who otherwise couldn't afford the entry costs.

CalHFA offers two categories of assistance:

| Category | Programs | Purpose |

|---|---|---|

| First Mortgages | CalHFA FHA, Conventional, VA, USDA, CalPLUS | The primary loan to buy your home |

| Down Payment Assistance | Dream For All, MyHome, ZIP | Cover down payment and closing costs |

CalHFA First Mortgage Products

| Program | Type | Credit | Max LTV | Key Features |

|---|---|---|---|---|

| CalHFA FHA | 30-year fixed | 640+ | 96.5% | Combines with MyHome; up to $1,209,750 in high-cost areas |

| CalHFA Conventional | 30-year fixed | 660-680+ | 97% | Fannie Mae HFA Preferred; reduced rates for ≤80% AMI |

| CalHFA VA | 30-year fixed | 640+ | 100% | Veterans only; no PMI; combines with MyHome |

| CalHFA USDA | 30-year fixed | 640+ | 100% | Rural areas only; no down payment |

| CalPLUS FHA | 30-year fixed | 660+ | 96.5% | Includes ZIP closing cost assistance |

| CalPLUS Conventional | 30-year fixed | 680+ | 97% | Includes ZIP closing cost assistance |

Dream For All: The $150,000 Shared Appreciation Loan

This is the program everyone wants.

Here's why:

Dream For All provides up to 20% of your purchase price (capped at $150,000) for down payment and closing costs.

But the best part?

There are no monthly payments. You only repay the loan when you eventually sell or refinance the home.

Dream For All Shared Appreciation Loan

Last Verified: January 3, 2026

- Assistance: Up to 20% of purchase price (max $150,000)

- Monthly payment: $0 (deferred)

- Repayment: Original amount + share of home appreciation

- Appreciation share: 20% if income >80% AMI; 15% if income ≤80% AMI

- First mortgage: Must use Dream For All Conventional loan

- Availability: Lottery—opens early 2026

How the Shared Appreciation Works

Dream For All isn't free money—it's a shared appreciation loan. When you sell or refinance, you repay the original assistance plus a percentage of your home's value increase.

| Scenario | Purchase | DFA Loan | Sale | Gain | Repay |

|---|---|---|---|---|---|

| Modest | $600K | $120K | $720K | $120K | $144K |

| Strong | $600K | $120K | $900K | $300K | $180K |

| No Growth | $600K | $120K | $600K | $0 | $120K |

Maximum appreciation cap: 2.5× original loan amount. If home depreciates, only principal is owed.

Dream For All Eligibility Requirements

Who Qualifies?

- First-Time Homebuyer

- Haven't owned or occupied a home in the last 3 years

- First-Generation Homebuyer (at least one borrower)

- Haven't owned a home in 7 years AND parents do not currently own a home in the US. Former foster youth also qualify.

- Income Limits

- Must be below Dream For All limits (lower than standard CalHFA limits)

- Credit Score

- Minimum 660 for conventional

- Maximum Contribution

- Borrower can contribute no more than 5% (ensures program reaches those in need)

Critical: Get Pre-Approved BEFORE the Lottery Opens

You need a CalHFA lender pre-approval letter to enter the Dream For All lottery. If you wait until registration opens to start the process, you'll miss the window.

Start working with a CalHFA-approved lender at least 60 days before the expected lottery date.

Want everything on one page? Get the free Dream For All 2026 Checklist—a 2-page PDF with eligibility, income limits, and the full document list.

MyHome Assistance Program: The Always-Available Option

Didn't win the Dream For All lottery? Don't qualify as first-generation?

MyHome is your backup plan.

Unlike Dream For All, MyHome is generally available year-round. No lottery. No limited funding windows. It's the reliable option you can actually plan around.

MyHome Assistance Program

- FHA Loans: Up to 3.5% of purchase price

- Conventional Loans: Up to 3% of purchase price

- VA/USDA Loans: 3% with $15,000 cap (cap waived for school employees)

- Interest Rate: ~1% simple interest

- Monthly Payment: $0 (deferred "silent second")

- Repayment: When you sell, refinance, or no longer occupy

MyHome Dollar Amounts by Home Price

| Home Price | MyHome FHA (3.5%) | MyHome Conv (3%) |

|---|---|---|

| $500,000 | $17,500 | $15,000 |

| $600,000 | $21,000 | $18,000 |

| $750,000 | $26,250 | $22,500 |

| $900,000 | $31,500 | $27,000 |

| $1,000,000 | $35,000 | $30,000 |

Zero Interest Program (ZIP) — Closing Cost Coverage

ZIP is specifically designed for closing costs—not down payment. It's only available with CalPLUS loans.

ZIP Program Details

- Amount: 2-3% of first mortgage loan amount

- Interest Rate: 0%

- Monthly Payment: $0 (deferred)

- Use: Closing costs and prepaid items only

- Required loan: CalPLUS FHA or CalPLUS Conventional

2026 CalHFA Income Limits by County (Verified)

⚠️ Income Limit Verification Notice

These figures are from the official CalHFA income limits PDF effective June 9, 2025. Always verify current limits at calhfa.ca.gov before applying.

| County | Standard CalHFA | Dream For All |

|---|---|---|

| San Francisco | $325,000 | $295,000 |

| San Mateo | $325,000 | $295,000 |

| Santa Clara | $325,000 | $309,000 |

| Alameda | $316,000 | $253,000 |

| Contra Costa | $316,000 | $253,000 |

| Orange | $270,000 | $216,000 |

| Ventura | $262,000 | $210,000 |

| San Diego | $258,000 | $207,000 |

| Sacramento | $239,000 | $191,000 |

| Los Angeles | $211,000 | $168,000 |

| Riverside | $205,000 | $164,000 |

| San Bernardino | $205,000 | $164,000 |

| Fresno | $185,000 | $148,000 |

Source: CalHFA Official Income Limits PDF, effective 06/09/2025

Part II: Local Programs — Southern California

This is where the real money is.

CalHFA offers 3–20% assistance. Local programs? Some offer $100,000+.

The catch: they're hyper-local. You need to know exactly which programs exist in your target city or county.

Los Angeles County

| Program | Amount | Eligibility | Status | Source |

|---|---|---|---|---|

| HOP80 | $100K (20%) | ≤80% AMI | Open | lacda.org ↗ |

| HOP120 | $85K (20%) | ≤120% AMI | Open | lacda.org ↗ |

| LIPA (City) | $161K | ≤80% AMI | Lottery | lahd ↗ |

| MIPA (City) | $90K-$115K | 80-150% AMI | Lottery | lahd ↗ |

| Long Beach | $25K grant | ≤200% AMI | Open | longbeach.gov ↗ |

MIPA Lottery Dates 2026: The City of LA MIPA program operates on a periodic lottery schedule. 2026 reservation dates: January 14 (18 slots) and June 10 (18 slots). Contact LAHD at [email protected] for details.

San Diego County

| Program | Amount | Eligibility | Status | Source |

|---|---|---|---|---|

| City Low | $125K + $10K | ≤80% AMI | Open | sdhc.org ↗ |

| City Middle | $40K + $10K | 80-150% AMI | Open | sdhc.org ↗ |

| County | 22% + 4% | ≤80% AMI | Open | sandiegocounty ↗ |

| Chula Vista | $120K | ≤80% AMI | Open | chulavistaca ↗ |

San Diego Special Feature

- City low-income program includes $10,000 closing cost GRANT that is forgiven

- Middle-income program converts to amortized loan after year 5

- All programs at 3% simple interest

Orange County

| Program | Amount | Eligibility | Status | Source |

|---|---|---|---|---|

| OC MAP | $80K (20%) | ≤80% AMI | Open | ochcd.org ↗ |

| Garden Grove | $50K-$110K | Varies | Open | ggcity.org ↗ |

| Anaheim BEGIN | $100K | ≤120% AMI | Open | anaheim.net ↗ |

Inland Empire (Riverside & San Bernardino)

| Program | Amount | Eligibility | Status | Source |

|---|---|---|---|---|

| Riverside HOME | $100K (20%) | ≤80% AMI | Open | rivcohws ↗ |

| Riverside PLHA | $100K (20%) | ≤80% AMI | Open | rivcohws ↗ |

| Riverside ARPA | $100K | ≤120% AMI | Open | rivcohws ↗ |

| NHSIE CalHome | $18K (10%) | ≤80% AMI | Open | nhsie.org ↗ |

Why Riverside County Stands Out

- Riverside programs are forgivable after the affordability period (15-30 years)

- Unlike most California programs that require repayment, these can be 100% free if you stay

- Combined with lower home prices, Inland Empire offers excellent value for first-time buyers

Part II: Local Programs — Bay Area

Bay Area programs offer the highest dollar amounts in the state.

They have to.

When median prices exceed $1 million, 3% down payment assistance doesn't move the needle. That's why San Francisco's DALP offers up to $500,000.

San Francisco

| Program | Amount | Eligibility | Status | Source |

|---|---|---|---|---|

| DALP | $500K | ≤200% AMI | Closed | sf.gov ↗ |

| Educators | $500K | SFUSD staff | Closed | sf.gov ↗ |

| 1st Responders | $500K | Police/Fire | Closed | sf.gov ↗ |

| BMR | Varies | ≤120% AMI | Open | sf.gov ↗ |

DALP Program Details

- Lottery-based (June 2025 lottery completed)

- 10-hour homebuyer education required through homesanfrancisco.org

- 1% minimum borrower contribution

- Maximum $80,000 liquid assets post-purchase

- Repayment includes proportionate share of appreciation

Santa Clara County (Silicon Valley)

| Program | Amount | Eligibility | Status | Source |

|---|---|---|---|---|

| Home Access | $200K (40%) | ≤80% AMI | Open | housingtrustsv ↗ |

| HELP | 10% | ≤140% AMI | Open | housingtrustsv ↗ |

| SCCR Grant | $10K grant | ≤100% AMI | Open | sccrfoundation ↗ |

| MCC | 15% tax credit | Varies | Open | calhfa ↗ |

Home Access Highlight: New program launched May 2025 covering Alameda AND Contra Costa counties. No shared appreciation requirement—only simple interest. 30-year deferred; minimum 3% borrower contribution. This is one of the best programs in California.

Other Bay Area Counties

| County | Program | Amount | Status | Source |

|---|---|---|---|---|

| San Mateo | HEART | $182K | Open | heartofsmc ↗ |

| Alameda | Home Access | $200K (40%) | Open | housingtrustsv ↗ |

| Sonoma | Santa Rosa DPA | $75K (10%) | Open | srcity.org ↗ |

| Sonoma | Burbank CalHome | $100K (40%) | Open | burbankhousing ↗ |

| Napa | City DPA | $150K (30%) | Open | cityofnapa ↗ |

Part II: Local Programs — Central & Northern California

Sacramento Region

| Program | Amount | Status | Source |

|---|---|---|---|

| PLHA FTHB | Varies | Weekly | shra.org ↗ |

| CalHome | Varies | Depleted | shra.org ↗ |

Central Valley

| Program | Amount | Status | Source |

|---|---|---|---|

| Fresno OpenHome | $25K grant | Hold | beyondhousingfresno ↗ |

| Modesto | $60K | Open | modestogov ↗ |

| San Joaquin GAP | $40K-$80K | Open | sjgov.org ↗ |

| Stanislaus | $50K (25%) | Hold | stancounty ↗ |

Fresno OpenHome Highlight

- True grant requiring no repayment

- For households ≤80% AMI ($67,440)

- Covers Fresno and Madera counties

- $500,000 program funding to assist 20-25 families

Coastal California

| Program | Amount | Type | Status | Source |

|---|---|---|---|---|

| Ventura—Oxnard | $40K forgivable | Forgiven 10 yrs | Open | mywayhome.org ↗ |

| Ventura—Camarillo | $50K deferred | 15-yr deferred | Open | ci.camarillo ↗ |

| Santa Barbara North | $100K deferred | Housing Trust | Open | sbhousingtrust ↗ |

Part III: Federal Loan Programs

Federal programs are the foundation.

They don't give you grants or forgivable loans. But they let you buy with as little as 0–3.5% down—which means you need less assistance to close the gap.

Stack a federal loan with state and local DPA, and you might not need any cash at all.

FHA Loans — The Workhorse

FHA Loan Key Features

- Down payment: 3.5% with 580+ credit; 10% with 500-579 credit

- 2025 California ceiling: $1,209,750 (1-unit, high-cost areas)

- Mortgage insurance: 1.75% upfront + 0.55% annual MIP

- MIP duration: Life of loan if <10% down; 11 years if ≥10% down

VA Loans — Zero Down for Veterans

VA Loan Advantages

- Down payment: $0 with full entitlement

- No PMI: Ever—saving $200-$500/month

- No loan limits: With full entitlement

- Funding fee (2025): 2.15% first use; waived for disability recipients

- Assumable: Future buyers can take over your VA loan

Cal-Vet Loans — California's Veteran Bonus

Cal-Vet Unique Features

- Up to 100% financing

- No minimum credit score (manual underwriting)

- Built-in life and disability insurance

- Works with foreclosure/bankruptcy history

- Rate advantage: ~25-35 basis points below market

USDA Loans — Zero Down in Rural California

USDA Loan Details

Down payment: $0. Geographic eligibility: Central Valley, Northern California, Eastern California, many suburban areas. Income limits (2025): $119,850 for 1-4 persons (standard); up to $194,550 in higher-cost areas. Fees: 1% upfront + 0.35% annual (lower than FHA).

Additional Federal Programs

| Program | Benefit | Eligibility | Source |

|---|---|---|---|

| Good Neighbor | 50% off HUD homes | Teachers, police, EMTs | hud.gov ↗ |

| HomeReady | 3% down | ≤80% AMI; 620+ | fanniemae ↗ |

| Home Possible | 3% down | ≤80% AMI; 660+ | freddiemac ↗ |

| Section 184 | 1.25% down, no PMI | Tribal members | hud.gov ↗ |

Part IV: Bank Grants & Credit Union Programs

Most buyers completely overlook these.

Major banks offer $5,000–$10,000 grants to compete for first-time buyers. Credit unions like Golden 1 offer matching programs up to $32,000.

The best part?

These stack with everything else. Add a bank grant on top of your CalHFA + local DPA combo and you might cover closing costs entirely.

Major Bank Grant Programs

| Bank | Program | Amount | Source |

|---|---|---|---|

| BofA | Home Grant | $7,500 | bankofamerica ↗ |

| BofA | Down Payment | $10,000 | bankofamerica ↗ |

| BofA | Community Affordable | $0 down | bankofamerica ↗ |

| Chase | Homebuyer Grant | $7,500 | chase.com ↗ |

| Wells Fargo | Access Grant | $10,000 | wellsfargo ↗ |

Credit Union Programs

Golden 1 WISH Grant — Up to $32,099

- Match ratio: 4:1 (e.g., $7,500 contribution = $30,000 grant)

- Maximum grant: $32,099

- Income limit: ≤80% AMI

- Closing cost credit: Up to $5,000 additional

- Availability: Through Golden 1 Credit Union

Other Credit Union Options

- SchoolsFirst HomeAccess: 3% down; lower PMI than FHA; exclusive to school employees

- Self-Help Federal CU: Accepts credit scores from 580; alternative credit history accepted; mission-focused nonprofit lender

Part V: Program Stacking Strategies

Here's the secret most buyers miss:

These programs are designed to work together.

You're not supposed to pick one. You're supposed to layer them—CalHFA first mortgage + MyHome + local DPA + bank grant. That's how buyers walk away from closing having paid almost nothing.

The Optimal Stacking Formula

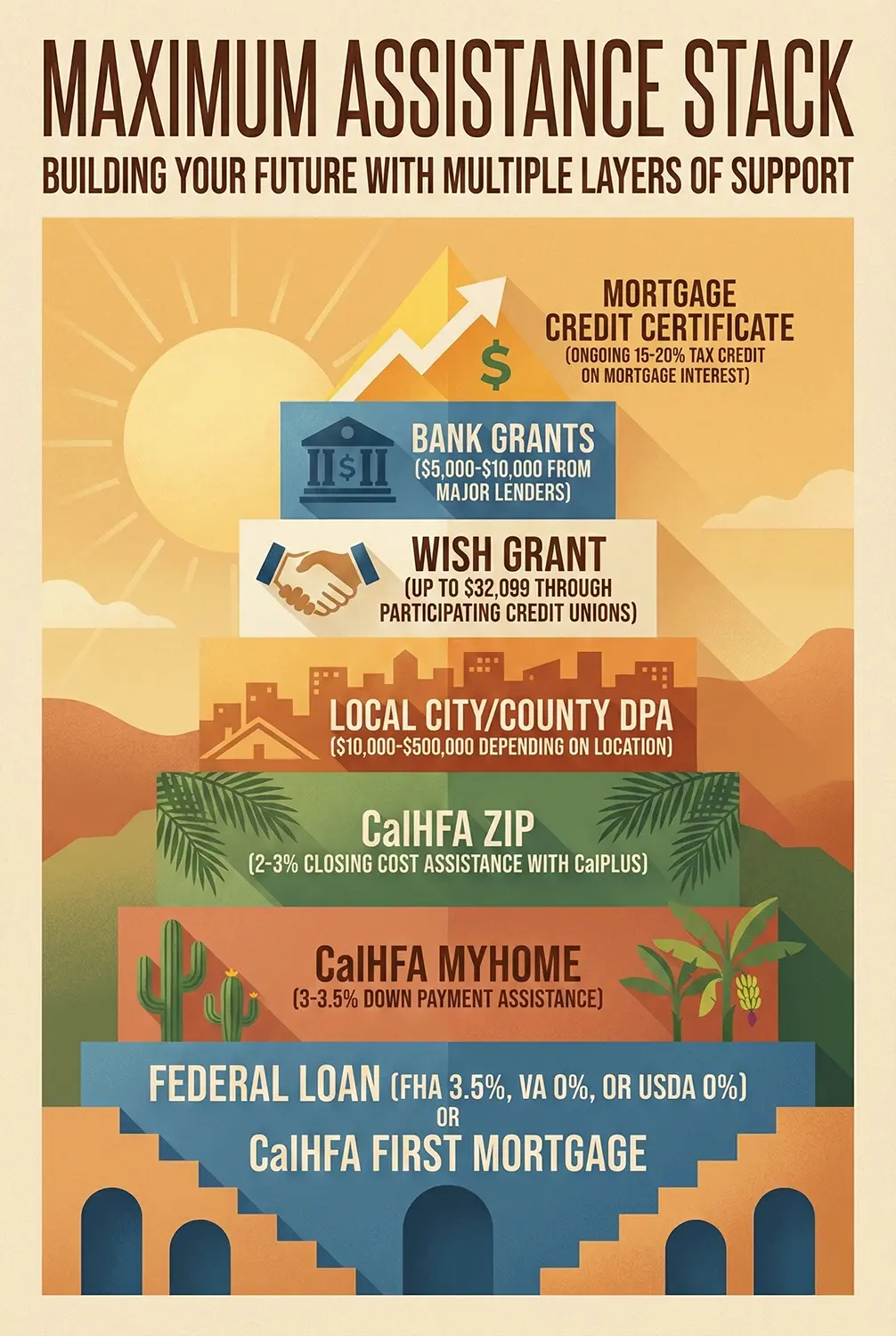

Maximum Assistance Stack

- Federal loan (FHA 3.5%, VA 0%, or USDA 0%) OR CalHFA first mortgage

- CalHFA MyHome (3-3.5% down payment assistance)

- CalHFA ZIP (2-3% closing cost assistance with CalPLUS)

- Local city/county DPA ($10,000-$500,000 depending on location)

- WISH Grant (up to $32,099 through participating credit unions)

- Bank grants ($5,000-$10,000 from major lenders)

- Mortgage Credit Certificate (ongoing 15-20% tax credit on mortgage interest)

Real Stacking Examples

Maximum Documented Cases

- San Francisco buyer: DALP ($375,000) + CalHFA first mortgage + MyHome (3%) = $400,000+

- Typical California buyer: CalHFA + MyHome + local DPA + WISH Grant = $50,000-$100,000

- Maximum documented: Four programs stacked totaling $107,500

Programs That Stack Well

Compatible Program Combinations

- CalHFA with any local DPA (most are designed to layer)

- Bank grants with government loans

- WISH with CalHFA or conventional loans

- MCC with all other programs (ongoing tax benefit)

- Employer assistance with government programs

- Gift funds with any program

Stacking Restrictions to Watch

Some programs cap total assistance at 20% of purchase price. Lien priority must be agreed upon (MyHome requires 2nd position). Must qualify under the most restrictive income limit. Dream For All limits borrower contribution to 5%.

Part VI: How to Apply — Step by Step

Universal Application Process

- Complete homebuyer education (8 hours, $100) — CalHFA requires eHome America; HUD-approved agencies accepted for most programs

- Gather documentation: 2 years tax returns and W-2s, 2 months bank statements, 30 days pay stubs, photo ID

- Find approved lender — CalHFA programs: Use CalHFA Preferred Loan Officer list

- Get pre-approved before house hunting

- Apply for DPA simultaneously with first mortgage

- Register for lotteries (Dream For All, DALP) when windows open

Program-Specific Application Portals

| Program | How to Apply |

|---|---|

| CalHFA | calhfa.ca.gov → Find Preferred Loan Officer |

| Dream For All | Lottery registration (opens early 2026) |

| SF DALP | sf.gov/apply-downpayment-loan |

| Housing Trust SV | housingtrustsv.org |

| San Diego programs | sdhc.org → First-Time Homebuyers |

| LA programs | Apply through LACDA.org or LAHD |

The CalHFA Lender Difference: The difference between an experienced DPA lender and a standard lender can be $50,000 or more in missed assistance. Always work with a CalHFA-approved lender who has experience stacking multiple programs.

Quick Reference: Best Programs by Situation

| Your Situation | Best Programs |

|---|---|

| Very low income (≤50% AMI) | Habitat for Humanity; USDA direct loans; local BMR programs |

| Low income (≤80% AMI) | Dream For All; local forgivable loans; WISH Grant + CalHFA |

| Moderate income (80-120% AMI) | CalHFA + MyHome; HOP120; HELP; bank grants |

| Higher income in high-cost area | SF DALP (200% AMI); HEART (San Mateo); CalHFA standard |

| Veteran | VA loan + CalVet + CalHFA MyHome |

| Teacher/first responder | Good Neighbor Next Door; SF Educators-DALP; SchoolsFirst |

| First-generation buyer | Dream For All ($150,000); Long Beach Grant ($25,000) |

| Credit challenged (580-640) | Self-Help CU (580 score); CalVet (no minimum); FHA (500+) |

Key Definitions

Essential Terms

- First-time homebuyer

- No ownership interest in principal residence in past 3 years

- First-generation homebuyer

- Parents have not owned a home in the US in past 7 years (Dream For All requirement)

- Area Median Income (AMI)

- Income limits set by HUD annually for each county

- Shared appreciation loan

- Repay principal plus percentage of home value appreciation when selling

- Deferred loan / Silent second

- No monthly payments; full balance due upon sale, refinance, or payoff

- Forgivable loan

- Loan balance eliminated after meeting occupancy requirements (typically 5-30 years)

- Mortgage Credit Certificate (MCC)

- Converts portion of mortgage interest to dollar-for-dollar federal tax credit annually

Frequently Asked Questions

Next Steps: Don't Leave Free Money on the Table

The funding is there. The programs are open. But they require paperwork and patience.

Your immediate next step?

Find a CalHFA-approved lender. Do not use a standard big-bank loan officer. You need a specialist who knows how to "stack" these programs to get you the full $50K–$150K you deserve.

Your 3-Step Action Plan

- Complete homebuyer education now — Don't wait. The 8-hour eHome course ($100) is required for every program, and you'll need the certificate before applying.

- Get pre-approved by a CalHFA lender — This positions you for the Dream For All lottery when it opens early 2026. Missing the window means waiting another cycle.

- Ask your lender about stacking — The difference between an experienced DPA lender and a standard lender can be $50,000 or more in missed assistance.

The programs exist. The money is available. The only question is whether you'll do the work to claim it.

Start with our free CalHFA Dream For All 2026 Checklist—everything you need on two pages.

Related Calculators

Helpful Resources

- Dream For All 2026 Checklist (PDF) - Free 2-page PDF with eligibility requirements, income limits, and application timeline

- CalHFA Down Payment Assistance Guide - Our complete breakdown of CalHFA programs, eligibility, and how to apply

- CalHFA Eligibility Tool - Check if you qualify for CalHFA programs

- Find a CalHFA Lender - Official lender search tool

- Dream For All Program - Official program information and registration

- eHome America - CalHFA-accepted online homebuyer education

- CalHFA Income Limits PDF - Official 2026 income limits by county

About Jon Teera

Jon Teera is the Lead Developer and Founder of CalcLogix. He builds tools that help first-time homebuyers navigate California's complex assistance programs—because understanding the rules shouldn't require a finance degree.

Read more about how we verify data →