⚡ Quick Summary

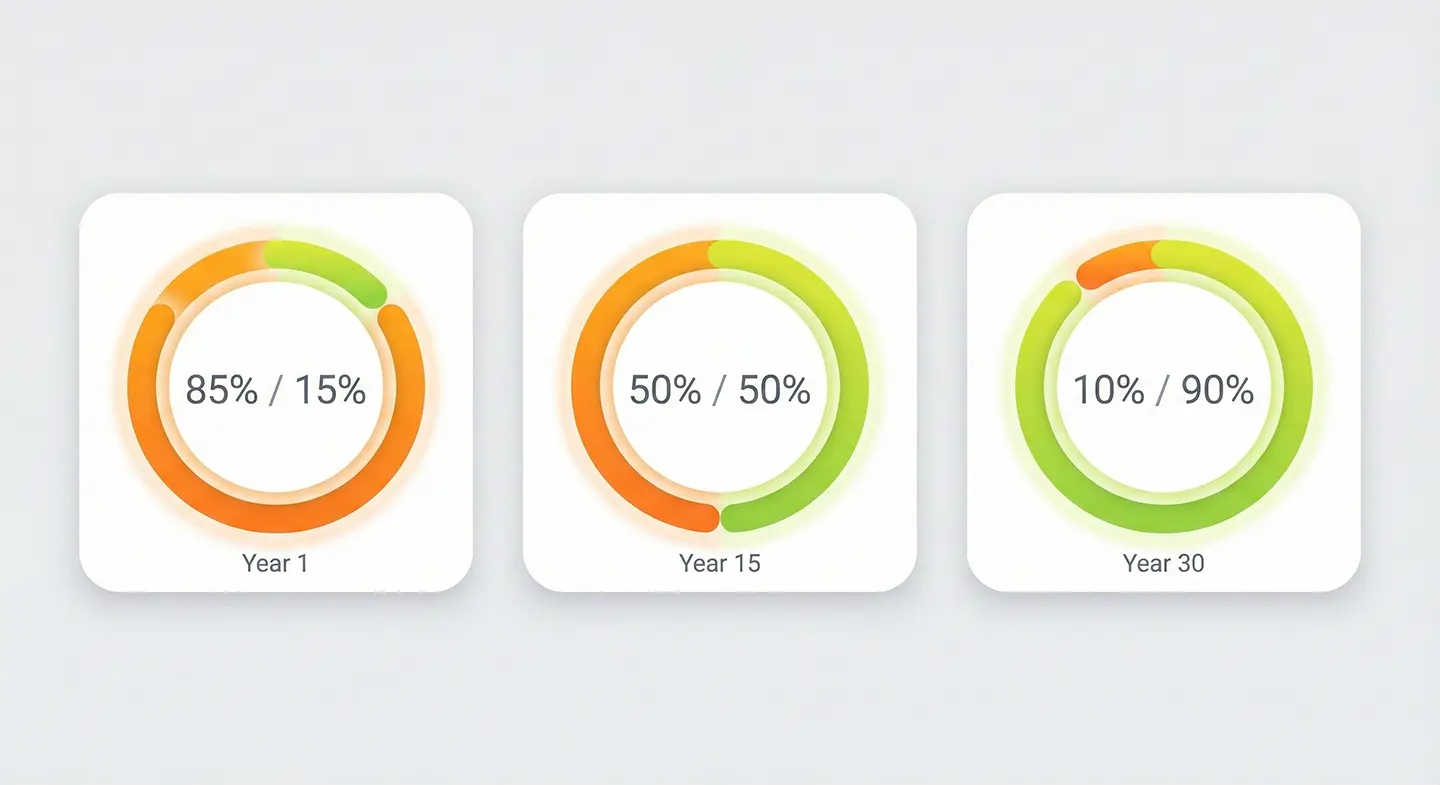

Amortization is why you pay $2,000/month but your loan balance only drops by $300. In the early years, ~85% of your payment goes to interest. On a $350,000 loan at 6.5% for 30 years, you'll pay $446,000+ in interest. Around year 18-20, payments finally split 50/50 between interest and principal. Calculate your own numbers →

You pay your mortgage on time every month.

$2,400 out of your bank account. Gone.

But when you check your loan balance a year later, it has barely moved.

What's going on?

The answer is Amortization.

And if you don't understand how it works, it can cost you hundreds of thousands of dollars in "phantom" interest costs.

The good news?

Once you see how the math works, you can "hack" the schedule to save massive amounts of money.

Here is exactly how to do it.

What Is Amortization? (The 30-Second Explanation)

📘 Definition

Amortization is the process of paying off a debt through fixed, regular payments over a set period. Each payment includes both principal (the amount borrowed) and interest (the cost of borrowing). The payment amount stays constant, but the proportion allocated to interest vs. principal shifts over time.

Simple enough, right?

But here's where it gets interesting:

While your payment amount stays the same each month, what's inside that payment changes dramatically over time.

In the early years, most of your payment goes toward interest. Very little chips away at the actual loan balance (the principal).

As the years go by, this ratio flips. By the end of your loan, almost your entire payment goes toward principal.

Why do lenders structure loans this way?

Because interest is calculated on your remaining balance. When your balance is high (at the start), you owe more interest. As your balance shrinks, so does the interest charge—leaving more room for principal.

Now, let me show you exactly how this calculation works.

⚡ Quick Facts: Amortization Basics

- What stays the same: Your monthly payment amount

- What changes: The interest/principal split within each payment

- Early payments: ~85% interest, ~15% principal

- Late payments: ~5% interest, ~95% principal

- Why it matters: Understanding this helps you make smarter decisions about extra payments and loan terms

Why Your Balance Doesn't Move (The Interest Trap)

Most people think their mortgage payment is a simple debt repayment.

It's not.

It's actually a split payment:

- Interest: Pure profit for the bank.

- Principal: The money that actually lowers your debt.

Here is the problem:

The bank stacks the deck against you. They structure the loan so that—in the beginning—almost zero dollars go toward paying off your house.

Look at the numbers:

Let's say you borrow $400,000 at 6.5% for 30 years.

Your first monthly payment is $2,528.

Guess how much of that actually lowers your debt?

$361.

The other $2,167? That goes straight to the bank as interest.

That means 86% of your hard-earned money in Year 1 isn't building equity. It's essentially rent paid to the bank.

But wait, it gets worse.

Because your balance barely drops in Year 1, your interest charge for Year 2 is almost exactly the same. It takes about 18 years before you finally start paying more principal than interest.

We call this the "Crossover Point." And reaching it faster is the secret to building wealth.

📊 By The Numbers

According to Freddie Mac's Primary Mortgage Market Survey, the average 30-year fixed mortgage rate as of December 2025 is approximately 6.19%. At this rate on a $400,000 loan:

- First payment: ~$2,450 total → ~$2,063 interest + ~$385 principal

- Year 1 total: ~$29,400 paid → only ~$4,800 goes to principal

- Total interest over 30 years: ~$478,000 (more than the original loan!)

Here's how lenders calculate your monthly interest:

Let's say you have a $400,000 mortgage at 6.5% interest.

Month 1 interest calculation:

- Loan balance: $400,000

- Annual rate: 6.5% (0.065)

- Monthly rate: 0.065 ÷ 12 = 0.00542

Monthly interest owed: $400,000 × 0.00542 = $2,167

If your total monthly payment is $2,528 (for a 30-year loan), here's the breakdown:

| Payment Component | Amount |

|---|---|

| Interest | $2,167 |

| Principal | $361 |

| Total Payment | $2,528 |

See the problem?

In your first payment, 86% goes to interest and only 14% actually reduces your loan.

But here's the good news:

This ratio improves with every single payment. As your balance drops, so does the interest charge—which means more of your payment goes toward principal.

The Math Behind Amortization (Don't Do This By Hand)

The math is complex, so don't do it manually—use the calculator.

But here's what you need to know about how it works:

Your lender uses a formula that calculates the exact payment amount needed to:

- Cover the interest owed each month

- Pay down principal

- Reach a $0 balance at exactly the end of your loan term

For example, a $350,000 loan at 6.5% interest for 30 years gives you a monthly payment of $2,212.24.

Skip the math: Use our Amortization Calculator and get your exact monthly payment, total interest, and full payment schedule in seconds.

Here's the shocking part:

Over 30 years, you'll pay $2,212.24 × 360 = $796,406 total. That means you'll pay $446,406 in interest—more than the original loan amount!

🚫 3 Amortization Myths (And the Truth)

- Myth #1: "Extra payments don't matter in the early years."

- Truth: Extra payments matter MOST early on. Every dollar you pay toward principal now saves you from paying interest on that dollar for the remaining 25-30 years. A $5,000 extra payment in year 1 saves far more than the same payment in year 20.

- Myth #2: "A lower monthly payment always means a better loan."

- Truth: Lower payments usually mean a longer term—and dramatically more total interest. A 30-year loan at $2,212/month costs $247,000 more in interest than a 15-year loan at $3,050/month for the same $350K loan.

- Myth #3: "Equity builds steadily each year."

- Truth: Equity builds slowly at first, then accelerates. In year 1, only ~15% of your payments build equity. By year 25, it's ~85%. Your equity curve is exponential, not linear.

Amortization Schedule Example: First 12 Months vs Last 12 Months

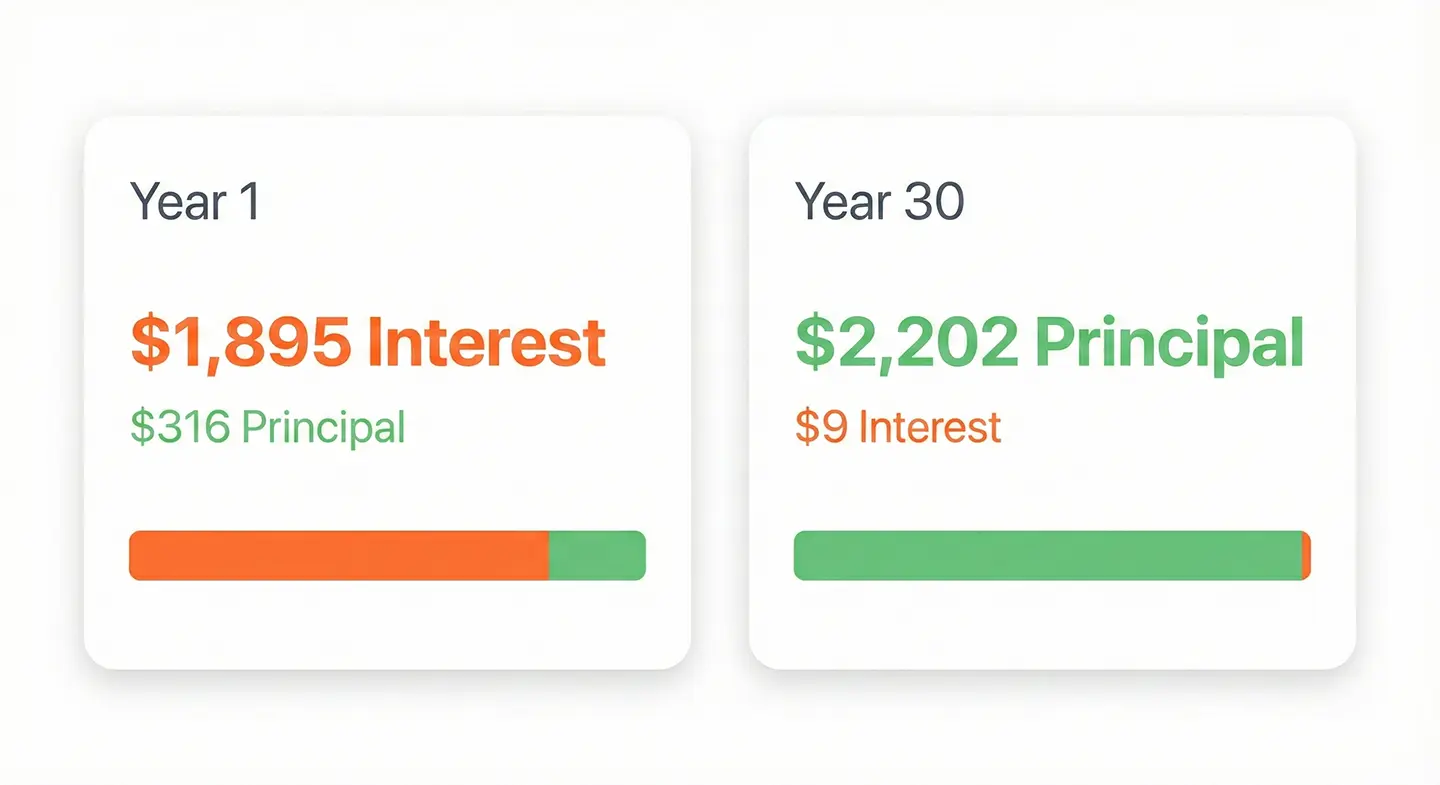

This is where amortization becomes real.

Let's look at the same $350,000 loan at 6.5% interest over 30 years.

Here's what your first year of payments looks like:

First 12 Months

| Month | Payment | Interest | Principal | Remaining Balance |

|---|---|---|---|---|

| 1 | $2,212.24 | $1,895.83 | $316.41 | $349,683.59 |

| 2 | $2,212.24 | $1,894.12 | $318.12 | $349,365.47 |

| 3 | $2,212.24 | $1,892.40 | $319.84 | $349,045.63 |

| 4 | $2,212.24 | $1,890.66 | $321.58 | $348,724.05 |

| 5 | $2,212.24 | $1,888.92 | $323.32 | $348,400.73 |

| 6 | $2,212.24 | $1,887.17 | $325.07 | $348,075.66 |

| 7 | $2,212.24 | $1,885.41 | $326.83 | $347,748.83 |

| 8 | $2,212.24 | $1,883.64 | $328.60 | $347,420.23 |

| 9 | $2,212.24 | $1,881.86 | $330.38 | $347,089.85 |

| 10 | $2,212.24 | $1,880.07 | $332.17 | $346,757.68 |

| 11 | $2,212.24 | $1,878.27 | $333.97 | $346,423.71 |

| 12 | $2,212.24 | $1,876.46 | $335.78 | $346,087.93 |

Year 1 totals:

- Total paid: $26,546.88

- Interest paid: $22,635.01

- Principal paid: $3,911.87

Read that again:

You handed over $26,546… and only $3,912 actually reduced your loan balance. The other $22,635? Gone. Paid to the bank as interest.

That's 85% of your first year's payments going straight to the lender's profit—not your equity.

But here's the flip side:

Now let's look at the last 12 months—payments 349 through 360:

Last 12 Months

| Month | Payment | Interest | Principal | Remaining Balance |

|---|---|---|---|---|

| 349 | $2,212.24 | $141.28 | $2,070.96 | $23,916.87 |

| 350 | $2,212.24 | $129.65 | $2,082.59 | $21,834.28 |

| 351 | $2,212.24 | $117.93 | $2,094.31 | $19,739.97 |

| 352 | $2,212.24 | $106.14 | $2,106.10 | $17,633.87 |

| 353 | $2,212.24 | $94.27 | $2,117.97 | $15,515.90 |

| 354 | $2,212.24 | $82.34 | $2,129.90 | $13,386.00 |

| 355 | $2,212.24 | $70.33 | $2,141.91 | $11,244.09 |

| 356 | $2,212.24 | $58.26 | $2,153.98 | $9,090.11 |

| 357 | $2,212.24 | $46.12 | $2,166.12 | $6,923.99 |

| 358 | $2,212.24 | $33.92 | $2,178.32 | $4,745.67 |

| 359 | $2,212.24 | $21.66 | $2,190.58 | $2,555.09 |

| 360 | $2,212.24 | $9.34 | $2,202.90 | $0.00 |

Year 30 totals:

- Total paid: $26,546.88

- Interest paid: $911.24

- Principal paid: $25,635.64

Same payment amount. Completely different breakdown.

In year 1, only 14.7% of your payments went to principal.

In year 30, 96.6% goes to principal.

How Different Loan Terms Affect Your Amortization

The loan term you choose dramatically impacts how much interest you'll pay.

Let's compare a $350,000 loan at 6.5% interest:

15-Year vs 30-Year Comparison

| Factor | 15-Year Loan | 30-Year Loan |

|---|---|---|

| Monthly Payment | $3,049.71 | $2,212.24 |

| Total Payments | $548,947.80 | $796,406.40 |

| Total Interest | $198,947.80 | $446,406.40 |

| Interest Savings | — | Costs $247,459 more |

Source: Calculated using standard amortization formula at 6.5% APR

The 15-year loan has a higher monthly payment ($837 more), but you save nearly $250,000 in interest.

Here's another way to think about it:

With a 30-year loan, you'll pay 127% of the home's value in interest alone.

With a 15-year loan, you pay 57% of the home's value in interest.

⚡ If/Then Decision Guide: Choosing Your Loan Term

- If you can afford ~40% higher monthly payments → Choose 15-year (save $200K+ in interest)

- If you need lower payments for cash flow → Choose 30-year (but consider extra payments when possible)

- If your rate is below 5% → 30-year may be fine (invest the payment difference instead)

- If your rate is above 6.5% → 15-year becomes more attractive (interest savings are massive)

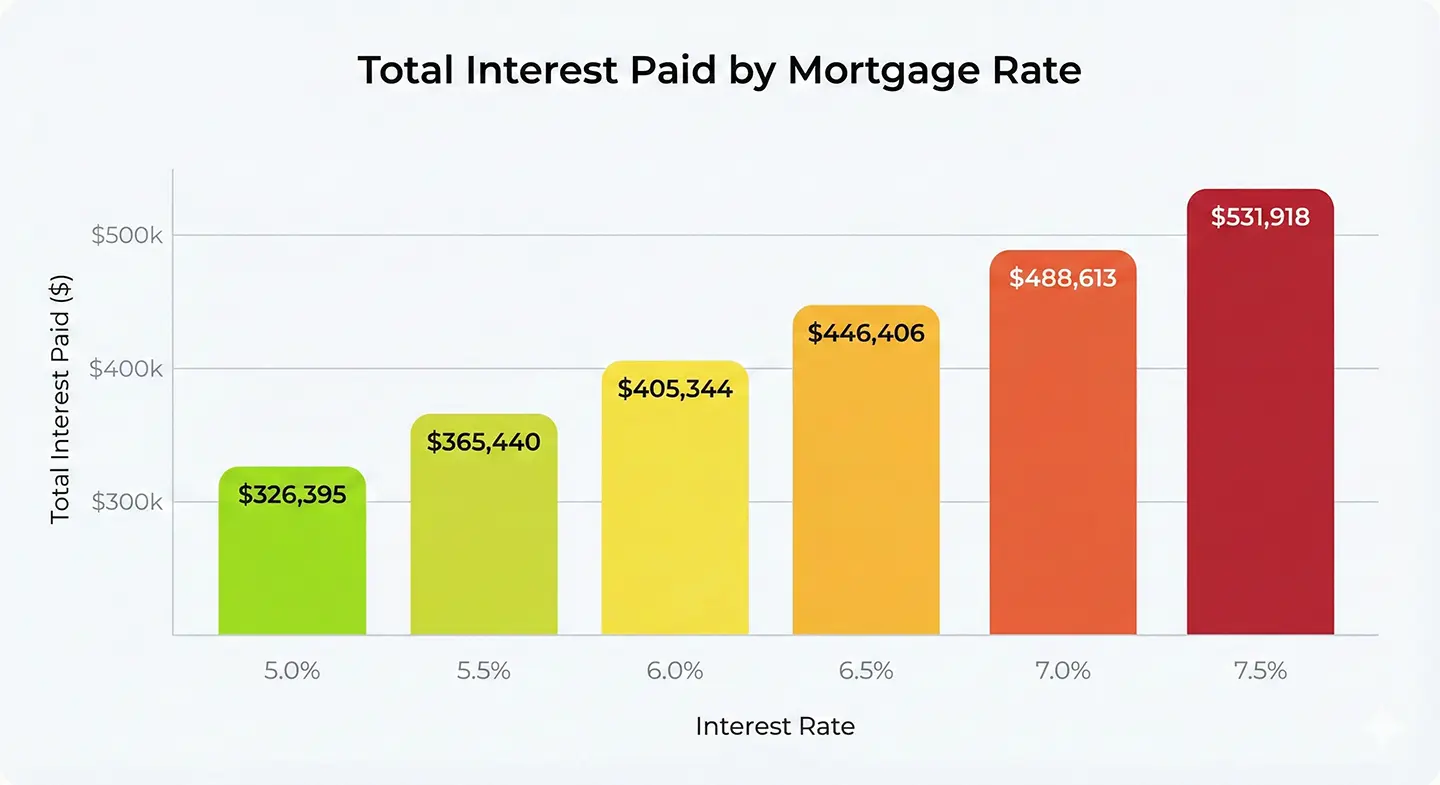

Impact of Interest Rate on Total Cost

Let's see how different rates affect a $350,000, 30-year mortgage (check today's mortgage rates to see where current rates fall):

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 5.0% | $1,879 | $326,395 |

| 5.5% | $1,987 | $365,440 |

| 6.0% | $2,098 | $405,344 |

| 6.5% | $2,212 | $446,406 |

| 7.0% | $2,329 | $488,613 |

| 7.5% | $2,447 | $531,918 |

Source: CalcLogix Amortization Engine | $350,000 principal, 30-year term

A 1% higher rate costs you roughly $80,000 more over 30 years. That's why the Federal Reserve recommends shopping around with multiple lenders—even a 0.25% difference can save you thousands.

Want to understand how rates are determined and how to get the best one? Read our Definitive Guide to Navigating Today's Mortgage Rates.

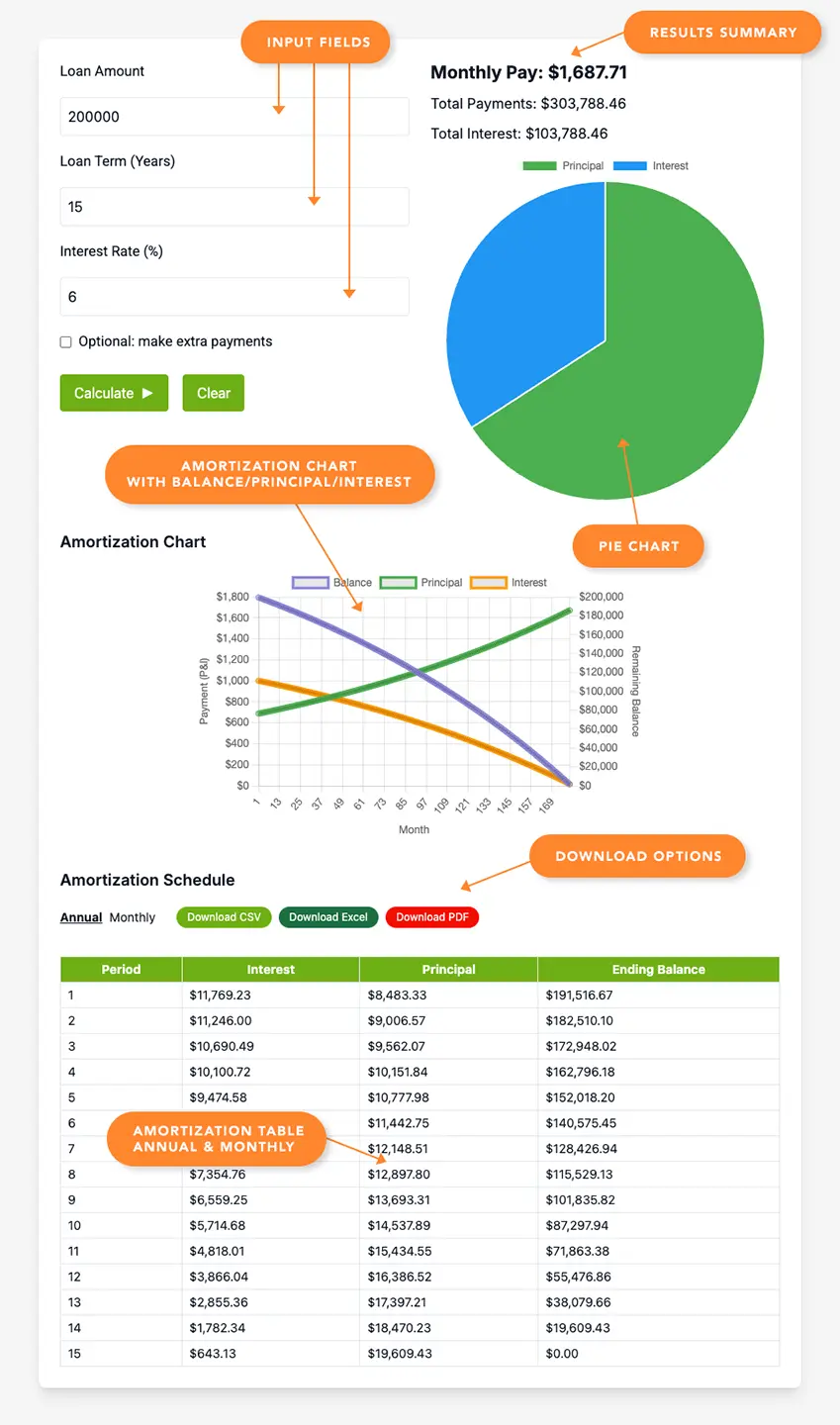

How to Use the CalcLogix Amortization Calculator

Want to see your own numbers? Here's how to use our Amortization Calculator to generate your personalized payment schedule.

Step 1: Enter Your Loan Details

Loan Amount: The total amount you're borrowing. For a mortgage, this is your home price minus your down payment. For example, if you're buying a $250,000 home with $50,000 down, enter $200,000.

Loan Term (Years): How long you'll take to pay off the loan. Common terms are 15 or 30 years for mortgages. Shorter terms mean higher monthly payments but dramatically less interest paid overall.

Interest Rate (%): Your annual interest rate. Enter just the number—for 6%, type "6" not "0.06". Even a small rate difference (like 6% vs 6.5%) can mean thousands in extra interest over the life of your loan.

Optional: Make Extra Payments: Check this box if you want to see how additional payments could shorten your loan and save interest. This is powerful for "what if" scenarios.

Step 2: Click "Calculate" and Review Your Results

Hit the green Calculate button. You'll instantly see:

- Monthly Pay: Your fixed monthly payment amount (principal + interest)

- Total Payments: The complete amount you'll pay over the life of the loan

- Total Interest: How much you'll pay just in interest—this number often surprises people

You'll also see a pie chart showing the proportion of your payments going to principal vs. interest over the entire loan.

Step 3: Explore the Amortization Chart

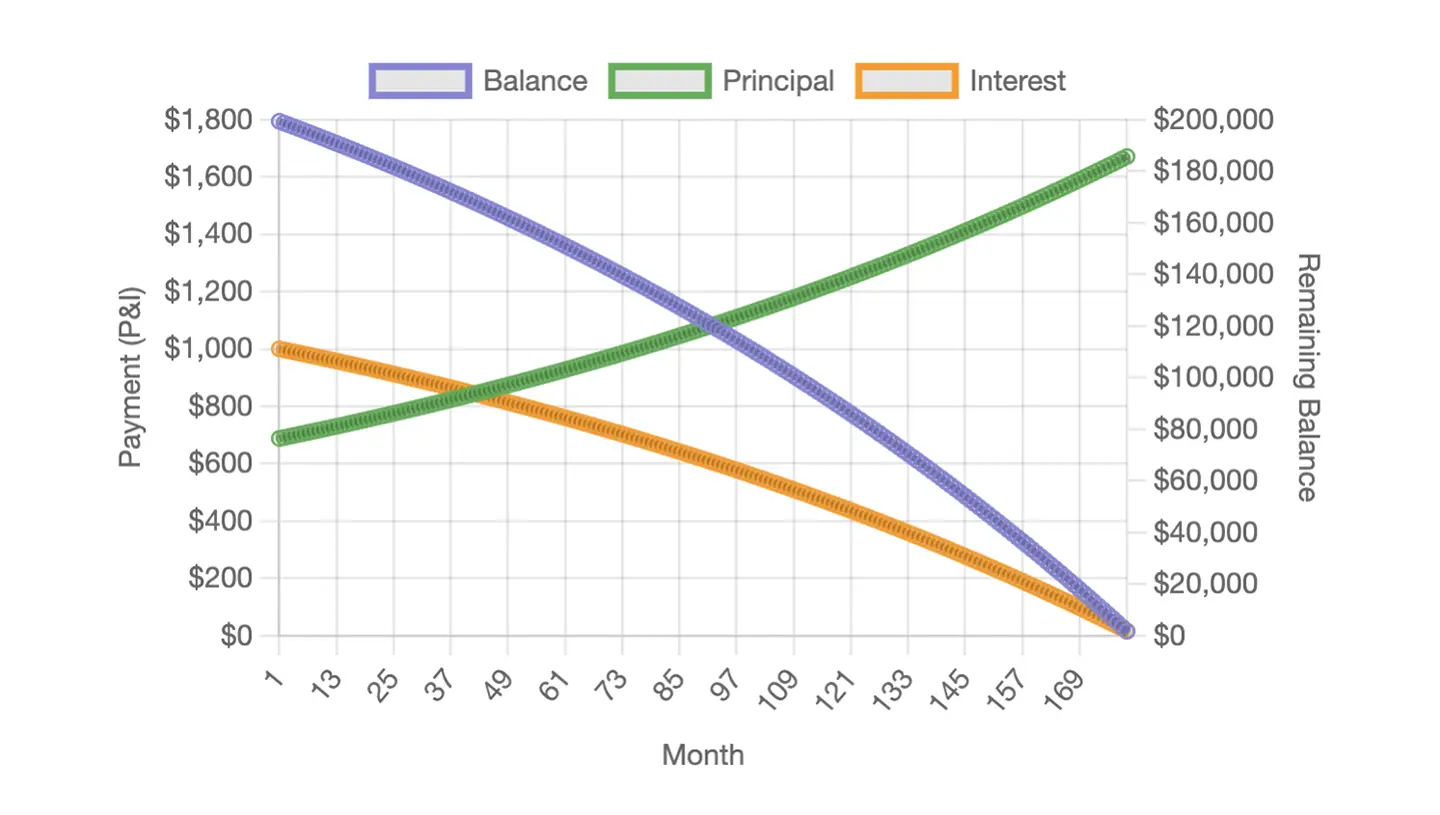

Below your results, you'll find an interactive Amortization Chart that visualizes your entire loan payoff journey:

- Blue line (Balance): Shows your remaining loan balance decreasing over time

- Green bars (Principal): The portion of each payment reducing your loan

- Orange bars (Interest): The portion going to interest charges

Watch how the green bars grow taller while the orange bars shrink—this is amortization in action.

Step 4: Download Your Complete Amortization Schedule

The Amortization Schedule table shows every single payment broken down by:

| Column | What It Shows |

|---|---|

| Period | Payment number (month or year) |

| Interest | Amount going to interest that period |

| Principal | Amount reducing your loan balance |

| Ending Balance | What you still owe after that payment |

Toggle between Annual and Monthly views depending on how much detail you want.

Pro tip: Download your schedule as CSV, Excel, or PDF using the buttons above the table. This is great for budgeting spreadsheets or sharing with a financial advisor.

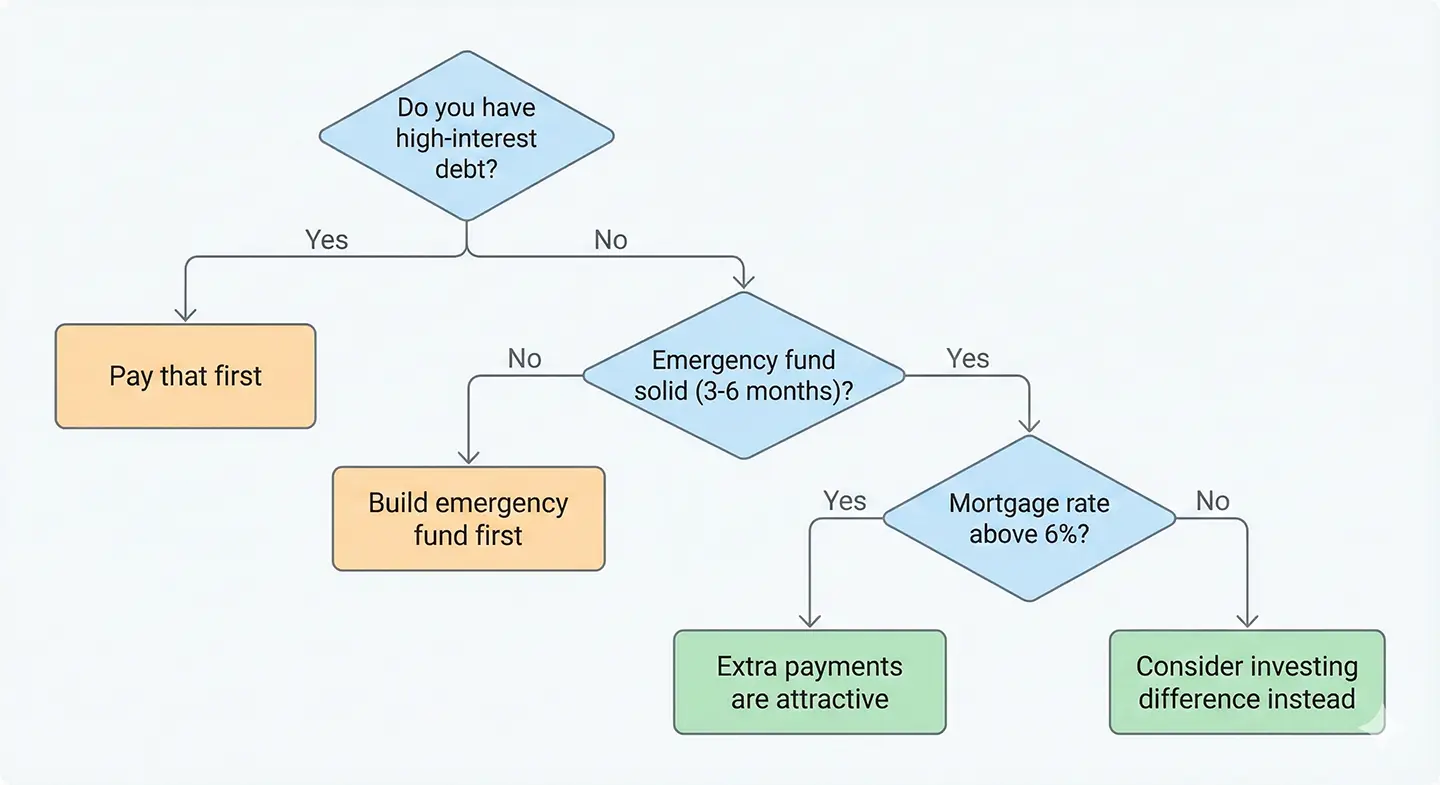

Should You Make Extra Payments? (3-Question Framework)

Making extra principal payments can save you tens of thousands in interest and help you pay off your mortgage years early.

But it's not always the right move.

Use this framework to decide:

Question 1: Do You Have High-Interest Debt?

If you have credit card balances at 18-25% interest, pay those first. Your mortgage at 6-7% is "cheap" debt by comparison.

Priority order:

- Credit cards (18%+)

- Personal loans (10-15%)

- Car loans (7-10%)

- Student loans (5-8%)

- Mortgage (5-7%)

Question 2: Is Your Emergency Fund Solid?

Financial experts recommend 3-6 months of expenses in liquid savings before aggressively paying down your mortgage.

Why? Because if you lose your job, your bank doesn't care that you made extra payments last year. They still want next month's payment.

Cash in savings = flexibility. Extra payments = locked up in your home.

Question 3: What's Your Mortgage Interest Rate?

If your rate is below 5%, you might earn better returns investing in the stock market (historically ~10% annual average) than paying extra on your mortgage.

If your rate is above 6%, extra payments become more attractive because you're essentially "earning" that rate risk-free.

✅ Pros & Cons: Making Extra Mortgage Payments

✅ Pros

- Save tens of thousands in interest

- Pay off your mortgage years early

- Build equity faster

- Guaranteed "return" equal to your interest rate

- Reduce financial stress

❌ Cons

- Money is locked in home equity (less liquid)

- May miss higher returns from investing

- Won't help if you face short-term cash crunch

- Some loans have prepayment penalties

- Mortgage interest may be tax-deductible

Not sure if buying makes sense at all? Use our Rent vs Buy Calculator to compare the true long-term cost of renting versus owning.

Common Amortization Mistakes to Avoid

📖 Amortization Glossary

- Principal

- The original amount borrowed

- Interest

- The cost of borrowing, calculated as a percentage of remaining principal

- Amortization Schedule

- A table showing every payment broken into interest and principal

- Crossover Point

- When payments split 50/50 between interest and principal (~year 18-20)

- Prepayment Penalty

- A fee some lenders charge for paying off a loan early

- Recast

- Recalculating your payment based on current balance without refinancing

Mistake #1: Expecting to Build Equity Fast in Year 1

As we saw in the tables above, you might pay $26,000 in year one but only reduce your principal by $4,000. This is normal—not a sign of a bad loan.

Set realistic expectations and plan accordingly.

Mistake #2: Ignoring Total Interest Cost

Many buyers focus only on the monthly payment. But on a $350,000 loan at 6.5%, you'll pay $446,000+ in interest over 30 years.

Always look at the total cost, not just the monthly number.

Mistake #3: Automatically Choosing 30 Years

Yes, the payment is lower. But if you can comfortably afford a 15-year payment, you'll save a quarter million dollars in interest.

Run both scenarios in the calculator before deciding.

Mistake #4: Making Extra Payments Without Checking for Prepayment Penalties

Some loans charge fees for paying off early. Before making extra payments, verify your loan doesn't have a prepayment penalty. According to the Consumer Financial Protection Bureau (CFPB), most conventional loans don't have these penalties, but some do—especially certain types of subprime or non-qualified mortgages.

Mistake #5: Not Specifying "Apply to Principal"

When you make extra payments, explicitly tell your lender to apply it to principal only. Otherwise, they might just apply it to next month's payment—which doesn't save you interest.

FAQs About Amortization

What is amortization in simple terms?

Amortization is paying off a loan through equal monthly payments where each payment covers both interest and principal. The payment amount stays the same, but the portion going to interest decreases over time while the principal portion increases. For example, on a 30-year mortgage, early payments might be 85% interest and 15% principal, but by year 30, it flips to about 95% principal and 5% interest.

Why do I pay so much interest at the beginning of my mortgage?

Interest is calculated on your remaining loan balance each month. When your balance is highest (at the start of your loan), you owe more interest. As you make payments and your balance decreases, the interest charge shrinks, allowing more of your fixed payment to go toward reducing the principal. This is why on a $350,000 mortgage at 6.5%, your first year might see only $3,900 go to principal out of $26,500 in payments.

What is an amortization schedule?

An amortization schedule is a complete table showing every payment you'll make on your loan over its entire term. It breaks down each payment into its interest and principal components and shows your remaining balance after each payment. You can view it monthly or annually. Most amortization calculators let you download this schedule as a PDF, Excel, or CSV file for budgeting purposes.

How do I calculate my amortization?

The amortization formula is: M = P × [r(1+r)^n] ÷ [(1+r)^n - 1], where M is monthly payment, P is principal (loan amount), r is monthly interest rate (annual rate ÷ 12), and n is total number of payments. However, the easiest method is using an online amortization calculator where you simply enter your loan amount, interest rate, and loan term to get instant results including a full payment schedule.

What is the "crossover point" in amortization?

The crossover point is when your monthly payment splits 50/50 between interest and principal—the moment when you start paying more toward your loan balance than toward interest. For a 30-year mortgage at 6-7% interest, this typically occurs around year 18-20 of the loan. Before this point, the majority of your payment goes to interest; after it, the majority goes to principal.

Is a 15-year mortgage better than a 30-year mortgage?

It depends on your financial situation. A 15-year mortgage has higher monthly payments (typically 30-40% more) but saves you potentially hundreds of thousands in interest—often 50% or more compared to a 30-year loan. A 30-year mortgage offers lower monthly payments and more financial flexibility but costs significantly more in total interest. For example, on a $350,000 loan at 6.5%, a 15-year term saves about $247,000 in interest compared to a 30-year term.

How much can I save by making extra principal payments?

Even small extra payments can save tens of thousands in interest and shave years off your loan. For example, on a $400,000 loan at 7%, just $200 extra per month cuts 6.5 years off your mortgage and saves over $100,000 in interest. The key is ensuring your lender applies extra payments to principal only—specify this in writing or use your servicer's dedicated "additional principal" payment option. Use our Mortgage Payoff Calculator to see your specific savings.

Do all loans use amortization?

No, not all loans use amortization. Most installment loans (mortgages, auto loans, personal loans, student loans) are amortized. However, credit cards use revolving debt with variable payments, interest-only loans don't reduce principal during the interest-only period, and balloon payment loans require a large lump sum at the end. These non-amortizing loans work differently and don't follow a traditional amortization schedule.

Can I change my amortization schedule?

Yes, you can change your amortization schedule in two main ways. First, refinancing to a new loan gives you an entirely new amortization schedule with different terms. Second, making extra principal payments effectively shortens your payoff timeline without formally changing the loan—you'll pay off faster while keeping the same minimum payment requirement. Some borrowers also recast their mortgage, which recalculates payments based on the current balance.

What happens to my amortization if I refinance?

When you refinance, you start a brand new loan with a fresh amortization schedule. This means you'll go back to paying mostly interest at first, just like when you started your original loan. This "reset" is why refinancing only makes financial sense if you're getting a significantly lower interest rate (typically 0.5-1% or more), need to change your loan terms, or plan to stay in the home long enough to recoup closing costs through monthly savings. Use our Refinance Calculator to see if it's worth it for your situation.

📋 Summary: How Amortization Works

What is amortization?

The process of paying off a loan through equal monthly payments that cover both principal and interest over a set term.

How does it work?

Each payment is split between interest (calculated on remaining balance) and principal. Early payments are ~85% interest; late payments are ~95% principal.

Key formula:

Monthly Interest = (Loan Balance × Annual Rate) ÷ 12

Critical numbers to know:

- Crossover point (50/50 split): ~Year 18-20 on a 30-year loan

- Total interest on $350K at 6.5% for 30 years: ~$446,000

- Savings with 15-year vs 30-year: ~$247,000

- Impact of 1% rate difference: ~$80,000 over loan life

Best practices:

- Always look at total cost, not just monthly payment

- Consider 15-year loans if you can afford higher payments

- Make extra principal payments to accelerate payoff

- Specify "apply to principal only" on extra payments

- Use an amortization calculator to model different scenarios

Next Steps: See Your Own Numbers

Now that you understand how amortization works, it's time to see what it means for your situation.

Use our Amortization Calculator to:

- Generate your complete amortization schedule

- See exactly how much interest you'll pay

- Compare 15-year vs 30-year scenarios

- Download your schedule as PDF, Excel, or CSV

- Explore how extra payments could save you money

Tools to Manage Your Amortization

See how different loan terms and extra payments affect your total cost:

Helpful Resources

- Mortgage Rates Today – Check current rates to use in your calculations

- Mortgage Rates Guide – The definitive guide to navigating today's mortgage rates

- Housing Inventory Trends – See how low inventory is affecting home prices

About Jon Teera

Jon Teera is the Lead Developer and Founder of CalcLogix. Unlike traditional financial writers, Jon approaches personal finance as a data engineering problem. He builds custom calculators that factor in localized variables—like tax codes and insurance rates—that standard bank tools ignore.

Read more about how we verify data →