⚡ Quick Summary

Rates have stabilized around 6%, and experts don't expect a return to 3% anytime soon. However, you can still beat the market average by focusing on the one factor you control: your credit score spread. A 100-point difference means $100,000+ more in interest. Calculate your rate →

If you are waiting for mortgage rates to drop back to 3%, you might be waiting forever.

The hard truth?

The "pandemic lows" were an anomaly. The current rates of ~6.2% are actually normal by historical standards.

But that doesn't mean you have to settle for a high payment.

Here is the reality:

Most borrowers obsess over the Fed.

Smart borrowers obsess over their spread.

While you can't control the Federal Reserve, you can control your personal variance from the market rate. In 2025, the gap between a "good" credit score rate and a "fair" score rate has widened to nearly 1.5%.

On a $400,000 loan, that gap costs you $116,000 in extra interest.

This guide breaks down exactly where rates are headed in 2026—and how to position yourself to get the absolute floor rate available today.

Today's Mortgage Rates: December 2025 Snapshot

According to Freddie Mac's Primary Mortgage Market Survey (the gold standard for rate tracking), here's where rates stand as of December 4, 2025:

| Loan Type | Current Rate | 52-Week Range | Best For |

|---|---|---|---|

| 30-Year Fixed | 6.19% | 6.17%–7.04% | Long-term stability |

| 15-Year Fixed | 5.44% | 5.41%–6.27% | Faster payoff, big savings |

| 5/1 ARM | 5.55% | — | Short-term owners (5-7 years) |

| 30-Year Jumbo | 6.40–6.51% | 6.10%–7.45% | Loans over $806,500 |

| FHA 30-Year | 5.89–6.14% | 5.82%–6.59% | Lower down payment, flexible credit |

| VA 30-Year | 5.37–5.90% | 5.85%–6.60% | Eligible veterans (best rates!) |

| USDA | 5.60% | — | Rural properties |

Source: Freddie Mac PMMS, December 4, 2025

Government-backed loans (VA, FHA, USDA) consistently offer lower rates than conventional loans. VA loans are currently 0.30-0.80% below conventional rates—if you're eligible, this is a significant advantage.

What's unusual right now:

The jumbo-conforming spread has compressed to just 0.13-0.32%. If you're buying an expensive home, jumbo loans are more competitive than they've been in years.

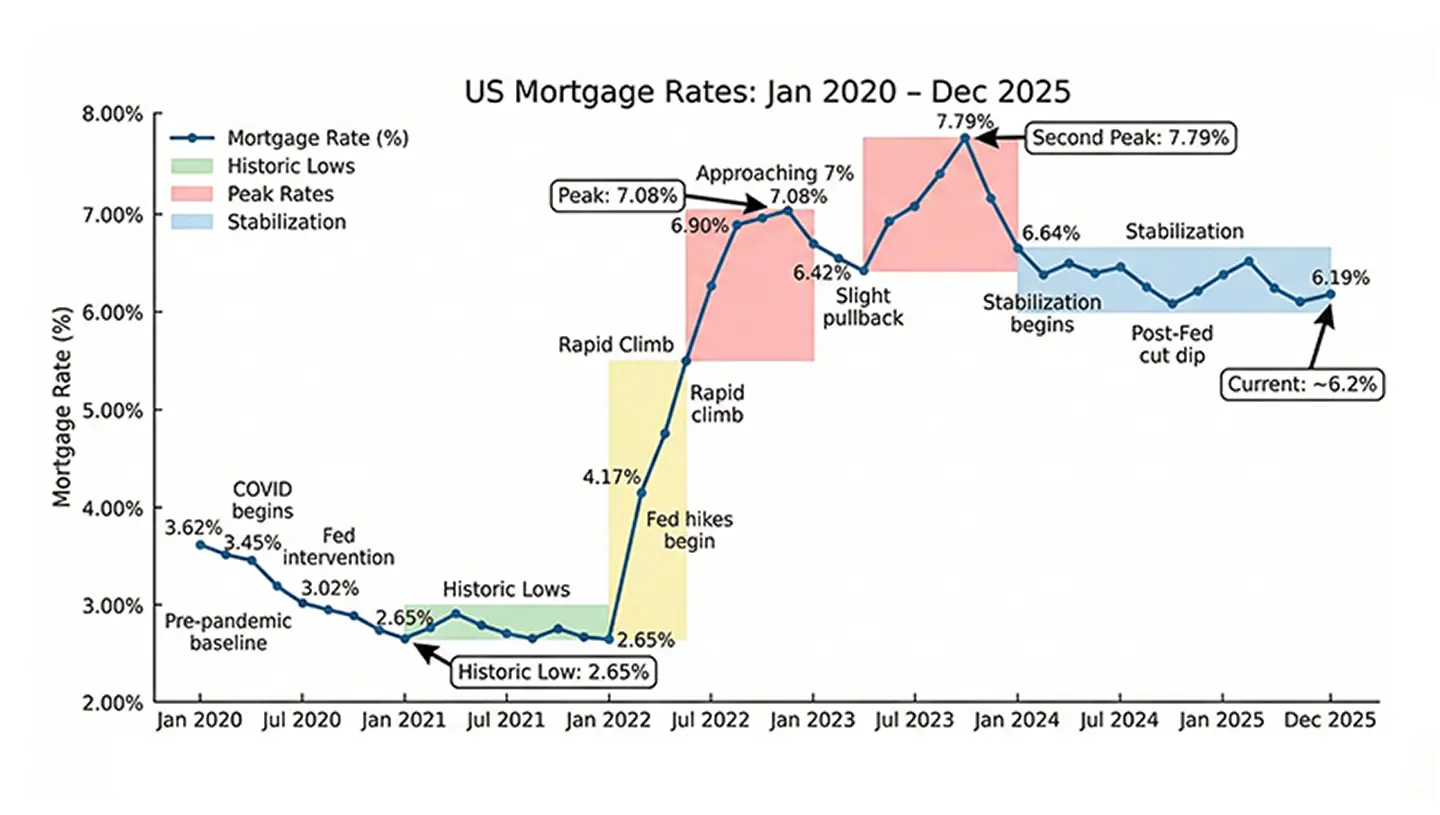

Historical Context: Where We've Been

To understand where rates might go, you need to see where they've been:

| Year | Average 30-Year Rate | What Happened |

|---|---|---|

| 2020 | 3.11% | Pandemic emergency cuts |

| 2021 | 2.96% (historic low!) | Rates hit 2.65% in January |

| 2022 | 5.32% | Fed starts aggressive hikes |

| 2023 | 6.80% | Peak of 7.79% in October |

| 2024 | 6.72% | Stabilization begins |

| 2025 (YTD) | ~6.50% | Gradual decline to 6.19% |

📊 Key Stat

The long-term average 30-year fixed rate since 1971 is 7.71%. Today's 6.19% is actually below the historical norm—even though it feels high compared to the pandemic-era anomaly.

What Actually Drives Mortgage Rates (And What You Can Control)

Here's what most people get wrong about mortgage rates:

They think the Federal Reserve sets mortgage rates.

Not quite.

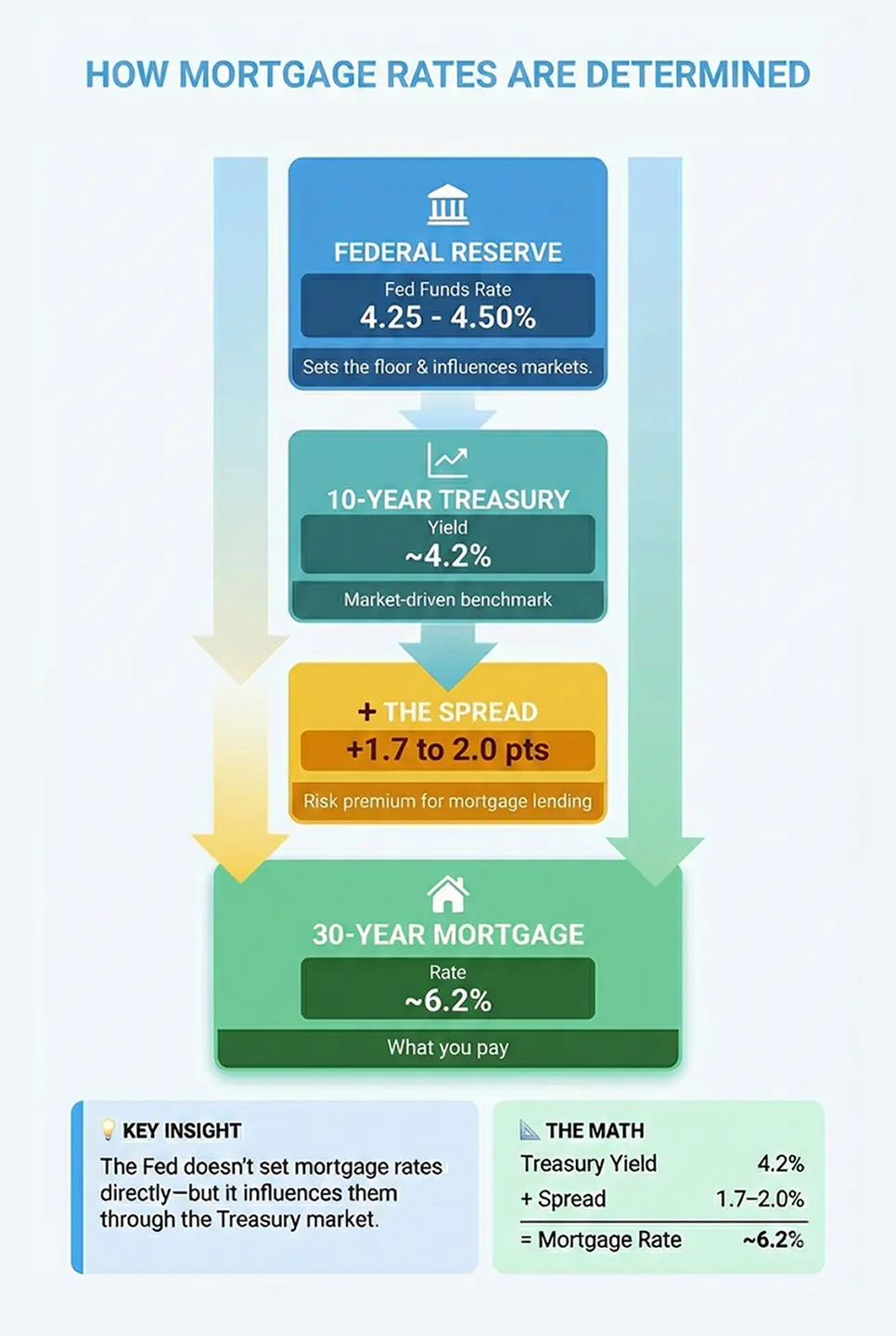

The Fed controls the federal funds rate—the overnight rate banks charge each other. Mortgage rates are influenced by this, but they're actually tied more closely to the 10-Year Treasury yield.

The Two Types of Rate Factors

Macro Factors vs. Personal Factors

🌍 Macro (You Can't Control)

- Federal Reserve policy

- 10-Year Treasury yields

- Inflation rates

- Economic growth

- Mortgage-backed securities demand

✅ Personal (You CAN Control)

- Credit score

- Down payment size

- Debt-to-income ratio

- Loan type choice

- How many lenders you shop

Understanding the Treasury Spread

Mortgage rates typically run 1.7-2.0 percentage points above the 10-Year Treasury yield. This "spread" covers the lender's risk and costs.

Here's what's unusual right now:

The current spread is around 2.05 percentage points—wider than the historical average. In 2023, it spiked above 3.0 points (the widest since 1986).

🔍 Why the Spread Matters

- Normal spread (1.7-1.8%): Mortgage rates move in sync with Treasuries

- Wide spread (2.0%+): Mortgage rates stay elevated even when Treasuries fall

- What's widening it: Fed's quantitative tightening, prepayment risk, economic uncertainty

- What would help: If the spread normalized, rates could fall 0.25-0.35% without any Fed action

The Fed's Current Position

The Federal Reserve has cut rates twice in 2025, bringing the federal funds rate to 3.75%-4.00%. But here's why mortgage rates haven't fallen as much as you'd expect:

📊 Fed vs. Mortgage Rates Disconnect

- Fed cuts since September 2025: 0.50% total

- Mortgage rate decline: Only ~0.25%

- Why the gap? Long-term rates (10-Year Treasury) remain elevated due to inflation expectations and federal deficit concerns

- Current inflation: CPI at 3.0%, still above the Fed's 2% target

So what does this mean for you?

Don't wait for the Fed to dramatically lower your mortgage rate. Focus on the factors you CAN control—especially your credit score.

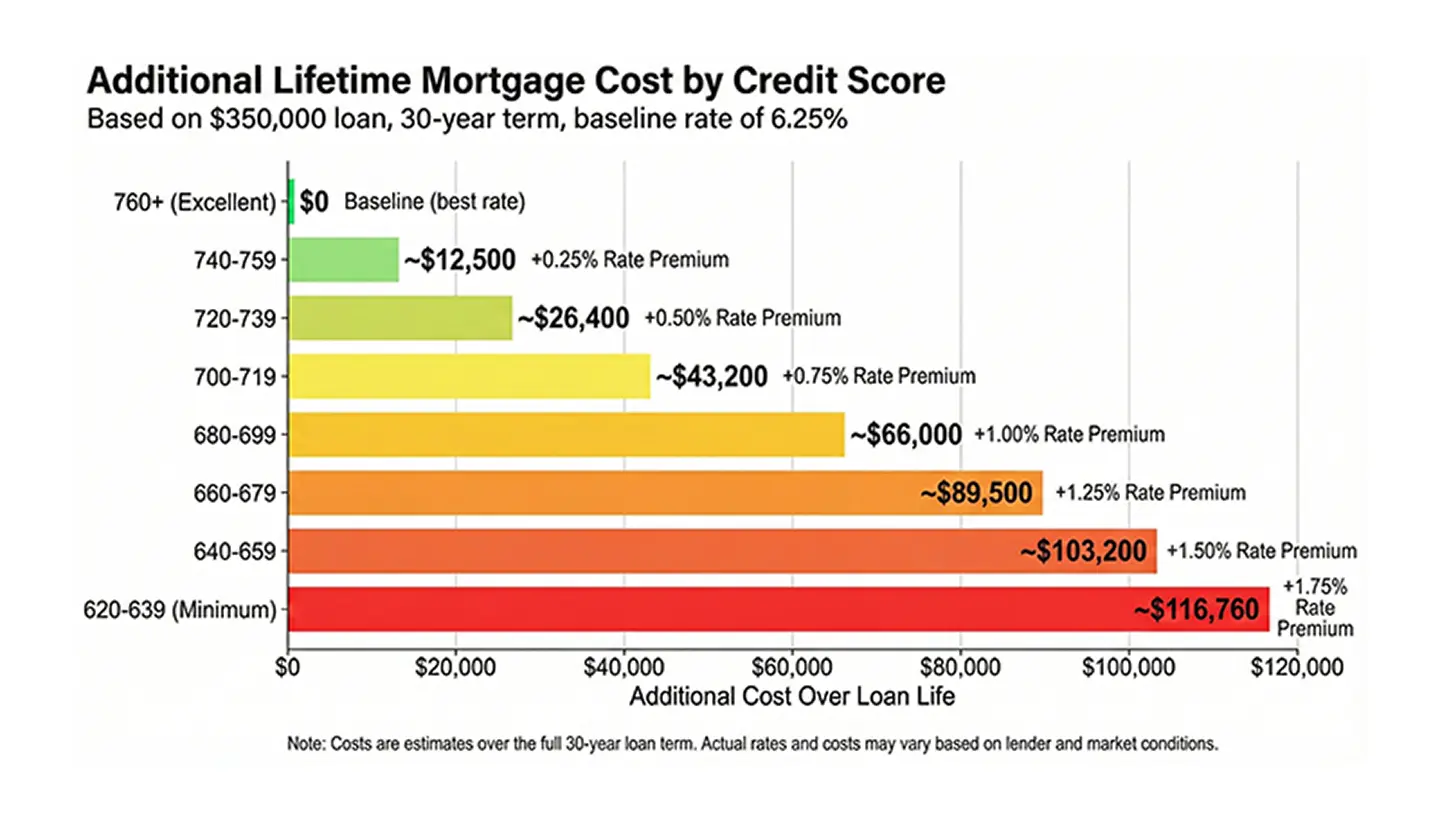

How Your Credit Score Impacts Your Rate (The $116,760 Difference)

This is the most underappreciated factor in mortgage rates.

Your credit score can swing your rate by 1.5+ percentage points—a difference that compounds into six figures over your loan's life.

Let me show you exactly what I mean:

| Credit Score | Typical APR | Monthly Payment* | Total Interest* | vs. 760+ Score |

|---|---|---|---|---|

| 760-850 (Excellent) | 6.46% | $1,889 | $379,920 | Baseline |

| 700-759 (Good) | 6.69% | $1,933 | $395,880 | +$15,960 |

| 680-699 (Fair) | 6.86% | $1,968 | $408,480 | +$28,560 |

| 660-679 | 7.08% | $2,012 | $424,320 | +$44,400 |

| 640-659 | 7.51% | $2,099 | $455,640 | +$75,720 |

| 620-639 (Minimum) | 8.05% | $2,213 | $496,680 | +$116,760 |

*Based on $300,000 loan, 30-year fixed. Rates as of December 2025.

A 620 score pays $116,760 MORE than a 760+ score on the exact same house.

Loan-Level Price Adjustments (LLPAs)

Beyond the rate difference, Fannie Mae and Freddie Mac add upfront fees based on your credit score and loan-to-value ratio. These are called Loan-Level Price Adjustments.

| Credit Score | LLPA at 80% LTV | Cost on $300K Loan |

|---|---|---|

| 780+ | 0.375% | $1,125 |

| 740-759 | 0.625% | $1,875 |

| 700-719 | 1.125% | $3,375 |

| 660-679 | 2.125% | $6,375 |

| Below 640 | 2.75% | $8,250 |

⚡ Critical Credit Score Thresholds

- 620: Minimum for conventional loans (below this = FHA or alternative options)

- 660: Substantially improved LLPAs and product access

- 680: Better PMI rates (0.38% annual vs. 0.96% for lower scores)

- 700: Jumbo loan eligibility threshold

- 740: Access to best "standard" rates

- 760+: Optimal rates and lowest LLPAs (the gold standard)

Quick Credit Score Wins Before Applying

Here's what actually moves the needle:

🚀 Fast Credit Improvements

- Pay down credit cards below 30% utilization → Can add 20-50 points within 30 days

- Become an authorized user on a family member's old, low-balance card → Instant history boost

- Dispute errors on your credit report → 79% of reports contain errors (CFPB data)

- Don't close old accounts → Length of history is 15% of your FICO score

- Avoid new credit applications → Each hard inquiry drops your score 5-10 points

⚠️ Warning: The Waiting Trade-Off

Improving from 660 to 740 might take 6-12 months. If home prices rise 3-5% in your market during that time, the higher purchase price might offset your rate savings. Calculate both scenarios using our mortgage calculator before deciding.

Fixed vs. Adjustable Rates: Which Is Right for You?

The 30-year fixed mortgage dominates the U.S. market—about 90% of borrowers choose it.

But is that always the smart choice?

Not necessarily. ARMs are making a comeback, and in certain situations, they can save you thousands.

| Factor | 30-Year Fixed | 15-Year Fixed | 5/1 ARM |

|---|---|---|---|

| Current Rate | 6.19% | 5.44% | 5.55% |

| Payment on $400K | $2,448 | $3,257 | $2,283 |

| Total Interest | $482,360 | $188,780 | Varies after Year 5 |

| Rate Changes? | Never | Never | Annually after Year 5 |

| Best For | Long-term owners, stability seekers | High income, fast payoff goal | Moving/refinancing within 5-7 years |

Fixed-Rate Mortgages

✅ Pros

- Predictable payments forever

- Protected from rate increases

- Easier budgeting

- Peace of mind

❌ Cons

- Higher initial rate than ARMs

- Pay more if you sell/refinance early

- Miss out if rates drop significantly

Adjustable-Rate Mortgages (ARMs)

✅ Pros

- Lower initial rate (0.5-0.75% savings)

- Lower payments during fixed period

- Rate caps limit worst-case scenarios

- Ideal if moving within 5-7 years

❌ Cons

- Payment uncertainty after fixed period

- Could increase significantly

- Harder to budget long-term

- Psychological stress for some

⚡ If/Then Decision Framework

- If you're staying 10+ years → Choose 30-year fixed

- If you can afford 40% higher payments → Consider 15-year fixed (saves $293K+ in interest)

- If you're moving or refinancing within 5 years → 5/1 ARM makes sense (save 0.64% on rate)

- If rates are expected to fall → ARM could win (adjustments might go DOWN)

- If you value sleep over savings → Fixed-rate always

The 15-Year Fixed: The Hidden Winner?

Most people dismiss the 15-year fixed because of the higher monthly payment. But look at the math on a $400,000 loan:

| Factor | 30-Year at 6.19% | 15-Year at 5.44% | Difference |

|---|---|---|---|

| Monthly Payment | $2,448 | $3,257 | +$809/month |

| Total Payments | $882,360 | $588,780 | -$293,580 |

| Total Interest | $482,360 | $188,780 | -$293,580 |

You pay $809 more per month but save nearly $300,000 over the loan's life.

Pro Tip: Can't afford the 15-year payment? Take the 30-year but make extra principal payments. Even $200-300/month extra cuts years off your loan. Use our Mortgage Payoff Calculator to see the impact.

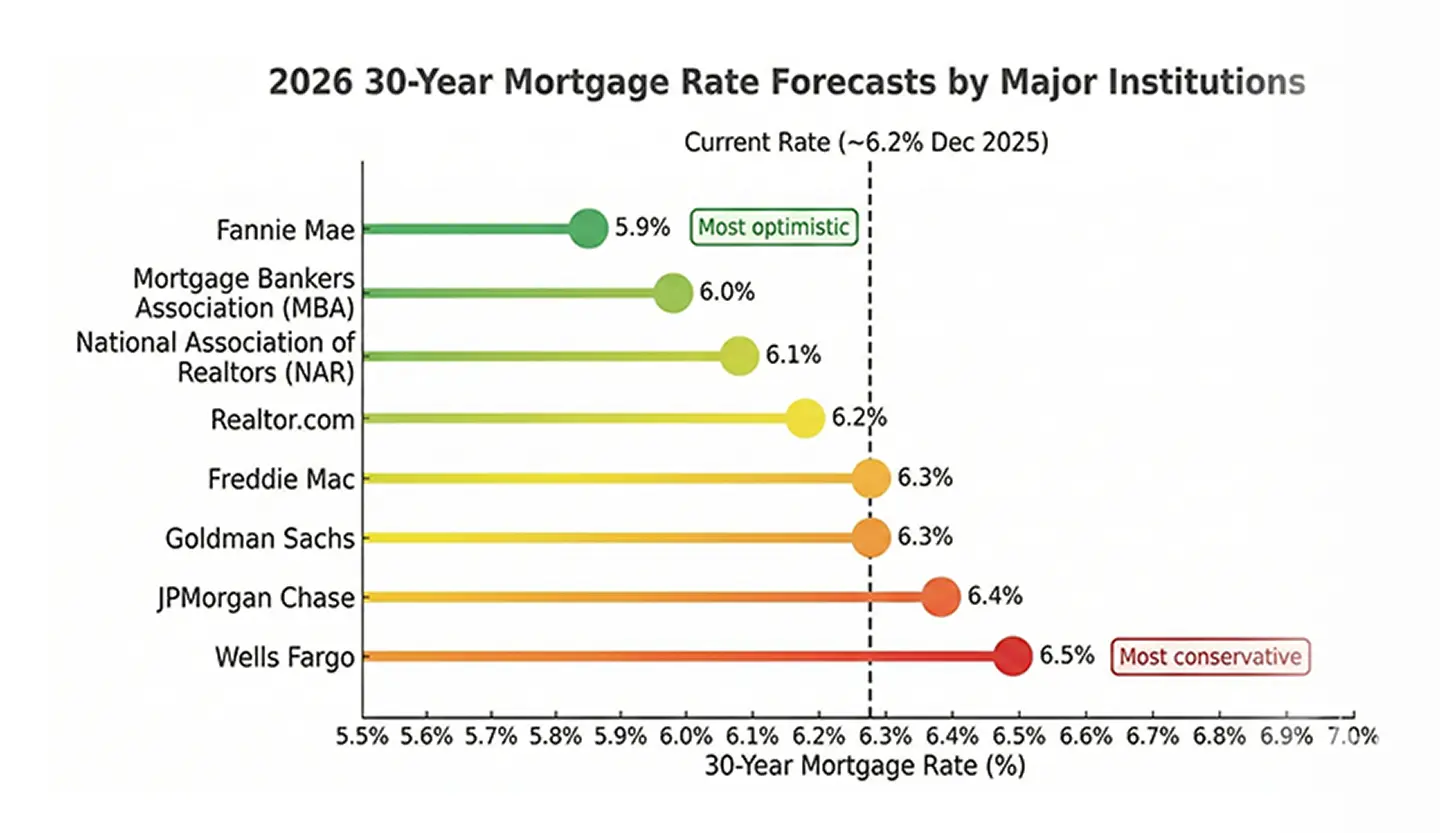

2026 Mortgage Rate Forecast: What the Experts Predict

Everyone wants to know: should I buy now or wait for lower rates?

Here's what the major forecasters are saying:

| Forecaster | 2026 Prediction | Key Assumptions |

|---|---|---|

| Fannie Mae (Most Optimistic) | 5.9% year-end | Continued Fed cuts; inflation at 2.6% |

| NAR | ~6.0% average | Easing Fed policy; steady employment |

| NAHB | 6.23% average | Inflation returns to target by 2027 |

| MBA (Conservative) | 6.4% steady all year | 10-Year Treasury above 4%; deficit pressures |

| Wells Fargo (Most Conservative) | 6.5% all year | Economic uncertainty; rates plateau |

Sources: Fannie Mae Housing Forecast, MBA Mortgage Finance Forecast, NAR Housing Outlook, November-December 2025

📊 Expert Consensus

- Range: 5.9% to 6.5% through 2026

- Sub-5% rates: Not expected to return anytime soon

- Pace: Any declines will be gradual, not dramatic

- Fed cuts: Won't automatically translate to much lower mortgage rates

What Would It Take for Rates to Drop Significantly?

For rates to fall below 5.5%, we'd likely need:

- A recession — The Fed would cut aggressively, Treasuries would fall

- Inflation sustainably at 2% — Currently at 3.0%, still above target

- Spread normalization — From 2.05% back to 1.7%

- Major economic shock — Similar to 2020 pandemic response

The bottom line?

Don't make your homebuying decision based on hopes of dramatically lower rates. The "new normal" appears to be around 6%.

⚡ What This Means For You

- If rates are above 7%: You might refinance into the low 6s within 12-24 months

- If rates are 6.0-6.5%: This is likely the "new normal"—don't wait for dramatic drops

- If you locked below 4%: Hold onto that mortgage! It's a valuable asset now

- If you're on the fence: Focus on finding the right home at the right price—you can always refinance later

How to Shop for Mortgage Rates (77% of People Skip This)

This might be the most important section in this entire guide.

77% of borrowers apply to only ONE lender.

That's a costly mistake.

📊 The Cost of Not Shopping

- Average savings from getting 5 quotes: $2,914 over the loan's life (Freddie Mac research)

- Rate variation between lenders: Up to 0.50% on the same day for identical borrowers

- In 2022-2023's volatile market: Shopping saved over $6,000 over 5 years

- Only 50% seriously consider more than one lender

Think about it: identical borrower profiles can receive quotes ranging from 6.0% to 6.5% on the same day. That 0.5% difference on a $400,000 loan equals $45,000 in extra interest.

📊 Case Study: The $22,000 Phone Call

Consider a borrower buying a $450,000 home with 10% down. Credit score: 720.

Quote from their bank: 6.625% with 0.5 points ($2,025 upfront)

Quote from online lender: 6.375% with no points

The math: $57/month saved, plus $2,025 in upfront fees avoided. Over 30 years: $22,545 saved—for about 4 hours of shopping work.

Your Rate Shopping Checklist

✅ How to Shop Smart

- Get at least 3-5 quotes from different lender types (bank, credit union, online lender, mortgage broker)

- Shop within 14-45 days — Multiple mortgage inquiries in this window count as ONE credit pull

- Compare APR, not just rate — APR includes fees and gives the true cost

- Get Loan Estimates — Lenders must provide this standardized form within 3 days of application

- Negotiate! — Use your best quote to ask other lenders to match or beat it

Pro Tip: The Loan Estimate is your best friend. Page 3 shows the "Comparisons" section with 5-year cost projections. Compare this number across lenders—it accounts for rate, fees, and PMI.

Where to Get Quotes

| Lender Type | Pros | Cons |

|---|---|---|

| Big Banks (Chase, Wells Fargo, BofA) | Convenience, existing relationship | Often higher rates, less flexibility |

| Credit Unions | Lower rates for members, personal service | Membership required, slower process |

| Online Lenders (Rocket, Better, etc.) | Competitive rates, fast process | Less hand-holding, fully digital |

| Mortgage Brokers | Shop multiple lenders for you, expertise | Broker fee, quality varies |

| Local/Regional Banks | Flexibility, portfolio lending options | Fewer tech tools |

Mortgage Points & Buydowns: When to Pay More Upfront

Should you pay upfront to lower your rate?

It depends on how long you'll keep the loan.

📘 What Are Mortgage Points?

One mortgage point (also called a "discount point") costs 1% of your loan amount and typically reduces your interest rate by about 0.25%. On a $400,000 loan, 1 point = $4,000 upfront.

The Points Math

Let's calculate whether points make sense on a $400,000 loan:

| Scenario | No Points | 2 Points ($8,000) |

|---|---|---|

| Interest Rate | 6.25% | 5.75% |

| Monthly Payment | $2,463 | $2,334 |

| Monthly Savings | — | $129 |

| Break-Even | — | 62 months (5.2 years) |

| Total Interest Saved | — | $46,440 over 30 years |

⚡ Should You Buy Points?

- If staying 5+ years: Points likely make sense (break-even typically 4-6 years)

- If selling/refinancing sooner: Skip points—you won't recoup the cost

- If cash is tight: Save for emergencies or a larger down payment instead

- If the seller offers to pay: Take it! It's free money

Temporary Buydowns: The 2-1 Buydown Explained

A 2-1 buydown reduces your rate by 2% in year one, 1% in year two, then returns to normal.

These are VERY popular right now.

On a $360,000 loan at 6.5%:

| Year | Effective Rate | Monthly Payment |

|---|---|---|

| Year 1 | 4.5% | $1,824 |

| Year 2 | 5.5% | $2,044 |

| Years 3-30 | 6.5% | $2,275 |

📊 Buydown Trends

- 61% of new construction now includes builder-paid rate buydowns

- Sellers increasingly offer buydowns to compete

- Important: You must qualify at the FULL rate (6.5%), not the reduced rate

- Unused buydown funds are typically non-refundable

Pro Tip: When negotiating, ask for a seller-paid buydown instead of a price reduction. A $10,000 buydown saves you money every month for years. A $10,000 price reduction saves you about $50/month.

Rate Lock Strategies: Protecting Your Rate

You've found a great rate. Now how do you keep it?

That's where rate locks come in.

📘 What Is a Rate Lock?

A rate lock guarantees your interest rate for a set period (typically 30-60 days) while your loan is processed. If rates rise during this time, you're protected. If rates fall, you're stuck—unless you have a float-down option.

How Long Should You Lock?

The average mortgage closing takes 41-44 days for purchases and 47 days for refinances. Here's what to consider:

| Lock Period | Best For | Cost Impact |

|---|---|---|

| 30 days | Fast closings, refinances | Lowest cost (baseline) |

| 45 days | Most purchases | +0.125% to rate or small fee |

| 60 days | New construction, complex deals | +0.25% to rate |

| 90+ days | Extended construction | +0.375-0.5% to rate |

⚡ When to Lock

- Lock immediately if: Rates are rising, you're risk-averse, or you're at the edge of affordability

- Consider waiting if: Rates are falling, you have a float-down option, or you're early in the process

- Always lock when: You have a signed purchase agreement and need payment certainty

Float-Down Options

Some lenders offer a float-down option that lets you capture a lower rate if the market improves after you lock.

📊 Float-Down Details

- Typical cost: 0.25-0.5% of loan amount or built into rate

- Rate drop required: Usually 0.25-0.5% minimum drop to exercise

- Best for: Longer lock periods when rate direction is uncertain

- Ask your lender: Not all lenders offer this—negotiate!

Pro Tip: Lock for 45 days on purchases to give yourself a cushion. If you're worried about missing lower rates, ask about float-down options before locking—it's easier to negotiate upfront than after.

Using the Mortgage Calculator

Numbers talk. Let's put everything you've learned into action with our free Mortgage Calculator.

Here's how to get the most out of it.

Step 1: Enter Your Loan Details

Home Price: The purchase price of the home you're considering. If you're not sure, use a realistic estimate for your target market.

Down Payment: Enter the amount or percentage you plan to put down. Remember: 20% avoids PMI, but many loan programs allow 3-5% down.

Interest Rate: Use today's rates from this guide, or the rate from your lender quote. Even a 0.25% difference changes your payment significantly.

Loan Term: Choose 30 years for lower payments or 15 years to save on interest. Try both to compare!

Step 2: Review Your Results

The calculator instantly shows you:

- Monthly Payment: Principal and interest (the core payment)

- Total of All Payments: What you'll pay over the entire loan

- Total Interest: Just the interest portion—this number often shocks people

- Amortization Chart: Visual breakdown of interest vs. principal over time

Step 3: Run "What If" Scenarios

Try these comparisons to make smarter decisions:

🔍 Scenarios to Test

- 15-year vs. 30-year: See the massive interest savings vs. higher payment

- Different down payments: Compare 5%, 10%, and 20% down

- Rate shopping impact: Try 6.25% vs. 6.75% to see why shopping matters

- Higher price home: See if stretching your budget really works

Try it now: Plug in a $400,000 home price with 20% down at 6.19% for 30 years. You'll see a monthly payment around $1,965 (P&I only) and total interest of about $386,000. Open the Mortgage Calculator →

5 Mortgage Rate Myths (And the Truth)

🚫 Myth #1: "The advertised rate is what I'll get"

- The Truth:

- Advertised rates are for borrowers with 760+ credit scores, 20%+ down payments, and perfect profiles. Most people qualify for rates 0.25%-1.0% higher. Always get a personalized quote.

🚫 Myth #2: "I need 20% down to get a good rate"

- The Truth:

- While 20% down avoids PMI, the rate difference is often only 0.125%-0.25%. FHA loans (3.5% down) and conventional loans (3% down) offer competitive rates. The bigger issue is PMI cost, not the rate itself.

🚫 Myth #3: "The Fed controls mortgage rates directly"

- The Truth:

- The Fed controls the federal funds rate (overnight bank lending). Mortgage rates follow the 10-Year Treasury yield, which is influenced by—but not controlled by—the Fed. That's why mortgage rates don't always move when the Fed cuts rates.

🚫 Myth #4: "Shopping for rates hurts my credit score"

- The Truth:

- Multiple mortgage inquiries within a 14-45 day window count as ONE inquiry for scoring purposes. The credit bureaus expect rate shopping and don't penalize it. Shop freely!

🚫 Myth #5: "I should wait for rates to drop significantly"

- The Truth:

- Experts predict rates will stay between 5.9%-6.5% through 2026. Meanwhile, home prices continue rising in most markets. Waiting for dramatically lower rates means competing with more buyers and paying higher prices. "Marry the house, date the rate"—you can always refinance later.

Frequently Asked Questions

What is a good mortgage rate in 2025?

As of December 2025, a "good" 30-year fixed rate is around 6.0-6.25% for borrowers with excellent credit (760+). The national average is 6.19%. If you're being quoted above 6.5% with good credit, shop around—you can likely do better. VA-eligible borrowers can often secure rates in the 5.3-5.9% range.

Will mortgage rates go down in 2026?

Most experts predict rates will stay between 5.9%-6.5% through 2026. Fannie Mae is the most optimistic, forecasting 5.9% by year-end 2026, while Wells Fargo expects rates to hold steady at 6.5%. Sub-5% rates are not expected to return without a significant economic recession.

How much does credit score affect mortgage rate?

Significantly. A borrower with a 620 credit score typically pays about 1.6% more than someone with a 760+ score. On a $300,000 loan, that difference equals $116,760 in extra interest over 30 years. Improving your score from 660 to 740 before applying can save tens of thousands.

Should I pay points to lower my rate?

It depends on how long you'll keep the loan. One point (1% of loan amount) typically reduces your rate by 0.25%. The break-even is usually 4-6 years. If you'll stay longer than that without refinancing, points make sense. If you might move or refinance sooner, skip them.

Is now a good time to buy a house?

Timing the market perfectly is nearly impossible. Current rates (around 6.19%) are below the historical average of 7.71%. Home prices continue rising in most markets. If you find a home you can afford at today's rates, waiting for dramatically lower rates may cost you more in higher home prices. Remember: you can refinance if rates drop, but you can't go back in time to buy at yesterday's prices.

What's the difference between APR and interest rate?

The interest rate is what you're charged on the loan balance. The APR (Annual Percentage Rate) includes the interest rate PLUS fees, points, and other costs, expressed as a yearly rate. APR gives you the true cost of borrowing and is better for comparing loan offers. A loan with a lower rate but high fees might have a higher APR than one with a slightly higher rate but lower fees.

How many lenders should I get quotes from?

At least 3-5 lenders. Freddie Mac research shows getting 5 quotes saves an average of $2,914 over the loan's life. Include different lender types: a big bank, credit union, online lender, and mortgage broker. All mortgage inquiries within a 14-45 day window count as one credit inquiry.

What is a rate lock and how long should I lock for?

A rate lock guarantees your interest rate for a set period (typically 30-60 days) while your loan is processed. The average closing takes 41-44 days for purchases. Lock for 45 days to be safe—longer locks cost slightly more. If rates are rising, lock immediately. Some lenders offer float-down options that let you capture lower rates if the market improves.

Are 15-year mortgages worth the higher payment?

If you can afford the payment, absolutely. On a $400,000 loan, a 15-year at 5.44% costs $820 more per month than a 30-year at 6.19%, but saves $293,580 in total interest. You also build equity much faster. If the higher payment would strain your budget, take the 30-year but make extra principal payments when you can.

Does the Fed lowering rates mean mortgage rates will drop?

Not directly or immediately. Mortgage rates follow the 10-Year Treasury yield, not the Fed funds rate. The Fed influences mortgage rates indirectly, but other factors like inflation expectations, economic growth, and investor demand for mortgage-backed securities also matter. That's why mortgage rates didn't fall as much as expected after the Fed's 2025 rate cuts.

Next Steps: Your Action Plan

You now know more about mortgage rates than most homebuyers—and probably more than some loan officers.

Here's your action plan:

🎯 Your Mortgage Rate Action Plan

Before You Apply (1-6 months out)

- Check your credit scores from all three bureaus (AnnualCreditReport.com is free)

- Pay down credit cards below 30% utilization for a quick score boost

- Avoid opening new credit accounts — each inquiry drops your score 5-10 points

- Save for down payment — more down = better rate and no PMI at 20%

- Calculate your debt-to-income ratio — lenders want 43% or less

When You're Ready to Shop

- Get quotes from 3-5 lenders (bank, credit union, online lender, broker)

- Compare APR and Loan Estimates — focus on Page 3 "Comparisons"

- Negotiate! Use your best quote to get others to match

- Ask about float-down options if rates might drop during processing

- Lock your rate with enough buffer time (45 days is safe)

Don't Forget

- A 0.5% rate difference = ~$45,000 on a $400K loan

- 77% of borrowers only get ONE quote—don't be one of them

- You can always refinance later if rates drop significantly

Your Next Step

Ready to see what you can afford? Use our calculators:

Helpful Resources

- Mortgage Rates Today – Check current rates to use in your calculations

- How Amortization Works – Understand how your payments split between principal and interest

- Housing Inventory Trends – See how low inventory is affecting home prices

About Jon Teera

Jon Teera is the Lead Developer and Founder of CalcLogix. Unlike traditional financial writers, Jon approaches personal finance as a data engineering problem. He built this guide to demystify mortgage rates and help homebuyers understand exactly what drives their interest rate—so you can negotiate from a position of knowledge, not hope.

Read more about how we verify data →