⚡ Quick Answer

Texas first-time homebuyers can access 75+ down payment assistance programs offering $5,000 to $125,000 in help. The main statewide options are My First Texas Home (TDHCA) and Home Sweet Texas (TSAHC), both providing up to 5% of your loan amount. Most programs require a 620 credit score, income below ~$100,000, and completion of a homebuyer education course. Many can be combined for maximum savings.

✅ Key Takeaways

- 75+ programs available: Texas offers more DPA options than almost any other state, from statewide programs to city-specific assistance

- Up to $125,000 in help: Houston's Harvey Homebuyer program leads, but typical assistance ranges from $15,000-$50,000

- 620 credit score minimum: Most programs accept 620+, making homeownership accessible to more Texans

- Grants vs forgivable loans: Many programs offer grants (never repay) or loans forgiven after 3-10 years

- Stacking is possible: You can often combine state + city programs + Mortgage Credit Certificate for maximum savings. Note: Stacking three programs requires a highly experienced lender and may extend closing timelines.

- Veterans get extra benefits: Texas VLB offers up to $828,200 in home loans plus discounted rates

📋 TL;DR

Best programs for most buyers: My First Texas Home (TDHCA) or Home Sweet Texas (TSAHC) for up to 5% DPA statewide. Teachers/first responders/veterans: Homes for Texas Heroes (5% DPA + FREE Mortgage Credit Certificate worth up to $2,000/year). City residents: Houston ($50,000), Austin ($40,000), Dallas ($60,000), San Antonio ($30,000). Key requirements: 620 credit, income limits vary by county (~$85K-$115K for family of 4), homebuyer education required. → Calculate your payment with DPA

Not Sure Which Program is Right for You?

Take our free 2-minute quiz to get personalized recommendations based on your situation.

Find My Programs →👤 Who This Guide Is For

- First-time Texas homebuyers looking for down payment help

- Teachers, first responders, and veterans eligible for special programs

- Repeat buyers who need assistance (yes, some programs allow this!)

- Buyers in major metros (Houston, Dallas, Austin, San Antonio, Fort Worth) with access to city-specific programs

- Anyone earning under ~$115,000 who thinks they can't afford a down payment

Buying your first home in Texas feels overwhelming—especially when you're staring at a median home price of $338,000 and wondering how you'll ever save enough for a down payment.

Here's the good news:

Texas offers more than 75 down payment assistance programs that could put $5,000 to $125,000 toward your home purchase. Many of these programs provide grants you never have to repay.

In this guide, you'll discover every major Texas first-time homebuyer program available in 2026, learn exactly how to qualify, and find out how to stack multiple programs for maximum savings.

Ready to see your own numbers? Jump to the Texas Mortgage Calculator or keep reading.

Quick Comparison: Best Texas First-Time Homebuyer Programs

Here's an at-a-glance comparison of the top programs most Texas first-time buyers should consider:

| Program | Max Assistance | Type | Best For |

|---|---|---|---|

| My First Texas Home (TDHCA) | Up to 5% | Grant or forgivable loan | Most first-time buyers statewide |

| Home Sweet Texas (TSAHC) | Up to 5% | Grant or forgivable loan | Buyers who need flexibility (no first-time requirement) |

| Homes for Texas Heroes | Up to 5% + free MCC | Grant + tax credit | Teachers, first responders, veterans |

| Texas VLB (Veterans) | Up to $828,200 loan | Below-market loan | Texas veterans and active military |

| City of Houston HAP | Up to $50,000 | Forgivable loan (5 years) | Houston residents below 80% AMI |

| City of Austin DPA | Up to $40,000 | Forgivable loan (5-10 years) | Austin buyers below 80% MFI |

| Dallas DHAP | Up to $60,000 | Forgivable loan | Dallas residents (high-opportunity areas) |

| San Antonio HIP 80 | Up to $30,000 | Forgivable loan (5-10 years) | San Antonio residents below 80% AMI |

| Texas Bootstrap Loan | Up to $45,000 at 0% | 0% interest loan | Buyers willing to provide sweat equity |

See your numbers: Use our Texas Mortgage Calculator to estimate your monthly payment with down payment assistance included.

📄 Want this as a printable PDF?

Get the top 10 programs, 2026 income limits, and document checklist in a free 2-page cheat sheet.

Get the Free Cheat Sheet →What Is a First-Time Homebuyer in Texas?

📘 Definition

In Texas, you're considered a first-time homebuyer if you haven't owned a home as your primary residence in the past three years. This definition is consistent across most state and local programs.

This is broader than most people think:

- You owned a home 4+ years ago? You qualify.

- You owned an investment property but never lived in it? You qualify.

- You're divorced and your ex kept the house? You likely qualify.

- You're a veteran? Many programs waive the first-time requirement entirely.

Good news for repeat buyers: Several programs—like My Choice Texas Home and Home Sweet Texas—are open to repeat buyers too. Don't assume you're disqualified!

Statewide Texas First-Time Homebuyer Programs

Texas offers powerful statewide programs through two main agencies: TDHCA (Texas Department of Housing and Community Affairs) and TSAHC (Texas State Affordable Housing Corporation).

My First Texas Home Program (TDHCA)

🏠 My First Texas Home

Up to 5% DPAWhat You Get:

- 30-year fixed-rate mortgage at competitive rates

- Up to 5% of loan amount for down payment and closing costs

- Choice of grant OR 0% interest deferred loan (forgivable after 3 years)

- Can be combined with Mortgage Credit Certificate (MCC) for tax savings

Eligibility Requirements:

- First-time homebuyer (no ownership in past 3 years) OR veteran OR buying in targeted area

- Minimum credit score: 620 (640 for manufactured homes)

- Income limits vary by county (approximately $86,000-$115,000 for family of 4)

- Purchase price limits vary by county (typically $350,000-$500,000+)

- Must complete homebuyer education course

📊 Example Calculation

- Home price: $300,000

- 5% assistance: $15,000

- Your out-of-pocket: Reduced from ~$10,500 (3.5% FHA) to essentially $0

- Bonus: Closing costs covered too

My Choice Texas Home (TDHCA)

Similar to My First Texas Home, but with one key difference: no first-time homebuyer requirement.

⚡ My Choice Texas Home Quick Facts

- Same benefits as My First Texas Home (up to 5% DPA)

- Available to repeat buyers who still need assistance

- Same credit/income requirements as My First Texas Home

- Best for: Buyers who owned a home within the past 3 years

Home Sweet Texas Home Loan Program (TSAHC)

🏡 Home Sweet Texas

Up to 5% DPA + MCC OptionWhat You Get:

- Up to 5% assistance for down payment and closing costs

- Choose grant (never repay) OR forgivable loan (forgiven after 3 years)

- Can combine with Mortgage Credit Certificate for annual tax credit up to $2,000

- No first-time homebuyer requirement

Eligibility Requirements:

- Minimum credit score: 620

- Income limits vary by county (typically $70,000-$100,000)

- Must occupy as primary residence

- Must complete homebuyer education course

Homes for Texas Heroes (TSAHC)

🦸 Homes for Texas Heroes

5% DPA + FREE MCC ($2,000/year tax credit)If you work in a "hero" profession, this program offers the same benefits as Home Sweet Texas—plus a FREE Mortgage Credit Certificate worth up to $2,000/year in tax savings.

Qualifying Professions:

- Teachers (full-time in public schools)

- Police officers and corrections officers

- Firefighters

- EMS personnel (EMTs, paramedics)

- Veterans (any branch, honorably discharged)

- County jailers

- School nurses, counselors, librarians

- Allied health faculty

The MCC Advantage: A Mortgage Credit Certificate provides a dollar-for-dollar federal tax credit equal to 15-40% of your annual mortgage interest, up to $2,000 per year. Over a 10-year period, that's up to $20,000 in tax savings—on top of your down payment assistance!

Texas Mortgage Credit Certificate (MCC)

📘 What Is an MCC?

The MCC isn't down payment assistance—it's an annual tax credit that reduces your federal tax bill every year you live in your home. You receive 15-40% of your annual mortgage interest as a tax credit (not deduction), up to $2,000 per year, for the life of your loan.

Example: If you pay $12,000 in mortgage interest and your MCC rate is 20%, you get a $2,000 tax credit—actual money off your taxes owed, not just a deduction.

⚠️ Important Change

TSAHC's standalone MCC program has been discontinued. MCCs are now only available when combined with TSAHC's down payment assistance programs (Home Sweet Texas or Homes for Texas Heroes).

Texas Bootstrap Loan Program

🔨 Texas Bootstrap Loan

Up to $45,000 at 0% InterestThis unique program provides up to $45,000 at 0% interest for buyers willing to contribute "sweat equity" to build or rehabilitate their home.

What You Get:

- Up to $45,000 at 0% interest

- Loan terms up to 30 years

- Can combine with other funding sources

Requirements:

- Household income at or below 80% of Area Median Income

- Must provide at least 65% of labor to build/rehabilitate home

- Must work with certified Bootstrap administrator (often Habitat for Humanity)

- Must complete Owner-Builder Education Class

- Texas resident for at least 6 months

Best for: Buyers with more time than money who are willing to work alongside volunteers to build their home. In 2025, the Bootstrap Program celebrated 25 years, having provided over $68 million in home loans for nearly 2,200 Texas homes.

Texas Veterans Land Board (VLB) Programs

Texas veterans have access to some of the best homebuying benefits in the country through the Veterans Land Board.

🎖️ Veterans Housing Assistance Program (VHAP)

Up to $828,200 LoanWhat You Get:

- Home loans up to $828,200 (2026 Conforming Limit)

- Competitive fixed interest rates

- 15, 20, 25, or 30-year terms

- Veterans with 30%+ VA disability rating get discounted rates

- Can combine with VA loan for blended rate savings

- Little to no down payment required

Eligibility:

- Texas resident

- At least 90 days active duty (or discharged for service-connected disability)

- Honorable, general, or medical discharge

- Active-duty military, Texas National Guard, or Reserve members with 20 qualifying years

Unique Benefit: You can have one active loan in each VLB program (land, home, and home improvement) simultaneously. Once paid off, you can get another VLB loan.

Other VLB Programs

| Program | Purpose | Max Amount | Key Benefit |

|---|---|---|---|

| Veterans Land Loan | Buy land in Texas | At least 1 acre | Only 5% down, below-market rates |

| Veterans Home Improvement | Home repairs/upgrades | Up to $50,000 | No down payment required |

City-Specific Down Payment Assistance Programs

Many Texas cities offer their own assistance programs—often with higher assistance amounts than state programs. Here's what's available in the major metros:

Houston Area Programs

🌆 City of Houston Homebuyer Assistance Program

Up to $50,000- Max Assistance: Up to $50,000

- Type: 0% interest forgivable loan

- Forgiveness: 100% after 5 years of residency

- Income Limit: 80% of Area Median Income

- Requirements: First-time buyer, HUD homebuyer education, property within Houston city limits

🌀 Harvey Homebuyer Assistance Program 2.0

Up to $125,000- Max Assistance: Up to $125,000

- For: Houston residents who lived in Houston during Hurricane Harvey (August 25, 2017)

- Type: Forgivable loan with tiered compliance periods

- Income Limit: 120% AMI

- ⚠️ Note: Limited funding available. Check current status with City of Houston Housing.

Austin Area Programs

🎸 City of Austin Down Payment Assistance

Up to $40,000- Max Assistance: Up to $40,000

- Type: 0% interest forgivable loan

- Forgiveness: 5 years (under $15,000) or 10 years ($15,001-$40,000)

- Income Limit: 80% of Median Family Income (~$55,400 single, ~$78,750 family of 4)

- Purchase Price Limit: $579,025

- Requirements: First-time buyer, property in Austin Full Purpose city limits, HUD homebuyer education

🏔️ Travis County Hill Country Home DPA

- Max Assistance: Up to 6% of loan amount as grant

- Coverage: Anywhere in Travis County including Austin

Dallas-Fort Worth Area Programs

🏙️ Dallas Homebuyer Assistance Program (DHAP)

Up to $60,000- Max Assistance: Up to $50,000 (or $60,000 in High Opportunity Areas)

- Type: Forgivable deferred loan

- Income Limit: 80% AMI

- Price Limit: $342,000

- Requirements: Property within Dallas city limits, homebuyer education

🏗️ Dallas Anti-Displacement Program (DHAP 10)

Up to $50,000- For: Dallas residents who have lived in the city for 10+ years

- Income Range: 50%-120% AMI

- Purpose: Help long-term residents stay in gentrifying neighborhoods

🤠 City of Fort Worth HAP

Up to $25,000- Max Assistance: Up to $25,000

- Type: Forgivable loan

- Forgiveness: 5 years (under $15,000) or 10 years (up to $25,000)

- Income Limit: 80% AMI (~$85,350 for family of 4)

- Price Limits: $309,000 existing / $329,000 new construction

- Requirements: First-time buyer, Fort Worth city limits, homebuyer education

🏘️ Tarrant County HAP

- Max Assistance: Up to $50,000

- Type: 0% interest deferred loan, forgivable after 10-20 years

- For: Properties in Tarrant County outside Fort Worth, Arlington, Grand Prairie city limits

San Antonio Area Programs

🌵 San Antonio HIP 80

Up to $30,000- Max Assistance: $1,000-$30,000

- Type: 0% interest forgivable loan

- Forgiveness: 5 years (under $15,000) or 10 years ($15,001-$30,000)

- Income Limit: 80% AMI (~$54,150 single person in 2025)

- Price Limits: $244,000 existing / $257,000 new construction

🌵 San Antonio HIP 120

Up to $15,000- Max Assistance: $1,000-$15,000

- Type: 0% interest loan, 75% forgivable over 10 years

- Income Limit: 81%-120% AMI (~$81,150 single person)

- Price Limits: $305,200 existing / $325,800 new construction

Other City Programs

| City | Max Assistance | Key Details |

|---|---|---|

| Arlington | $20,000 | Income ≤80% AMI |

| Corpus Christi | $25,000 + $10,000 closing | 5 or 10-year forgivable |

| El Paso | $15,000 | Within city limits |

| Frisco | $10,000 | First-time buyers |

| Grand Prairie | $7,500 | First-time buyers |

| San Marcos | $12,000 | First-time buyers |

| Texarkana | $20,000 | Within city limits |

The "Stacking" Secret: How to Get $60,000+

Most buyers stop at one program. That is a $40,000 mistake.

Here is the strategy most loan officers won't mention unless you ask:

You can often stack multiple programs on top of each other.

💰 Powerful Combinations

1. State DPA + City DPA + MCC

My First Texas Home (5%) + City of Austin DPA ($40,000) + MCC ($2,000/year)

On a $400,000 home: $20,000 + $40,000 + ongoing tax credits = $60,000+ in assistance

2. TSAHC Heroes + MCC (Free)

Teachers, first responders get 5% DPA + free MCC

Result: Both down payment help AND annual tax savings

3. VLB + VA Loan

Texas VLB loan + federal VA loan = blended lower rate

Result: No down payment, no PMI possible

⚠️ What You Can't Combine

- Generally cannot use two state-level DPA programs simultaneously

- Check specific program rules—some prohibit "layering"

- Always verify with your lender before assuming programs stack

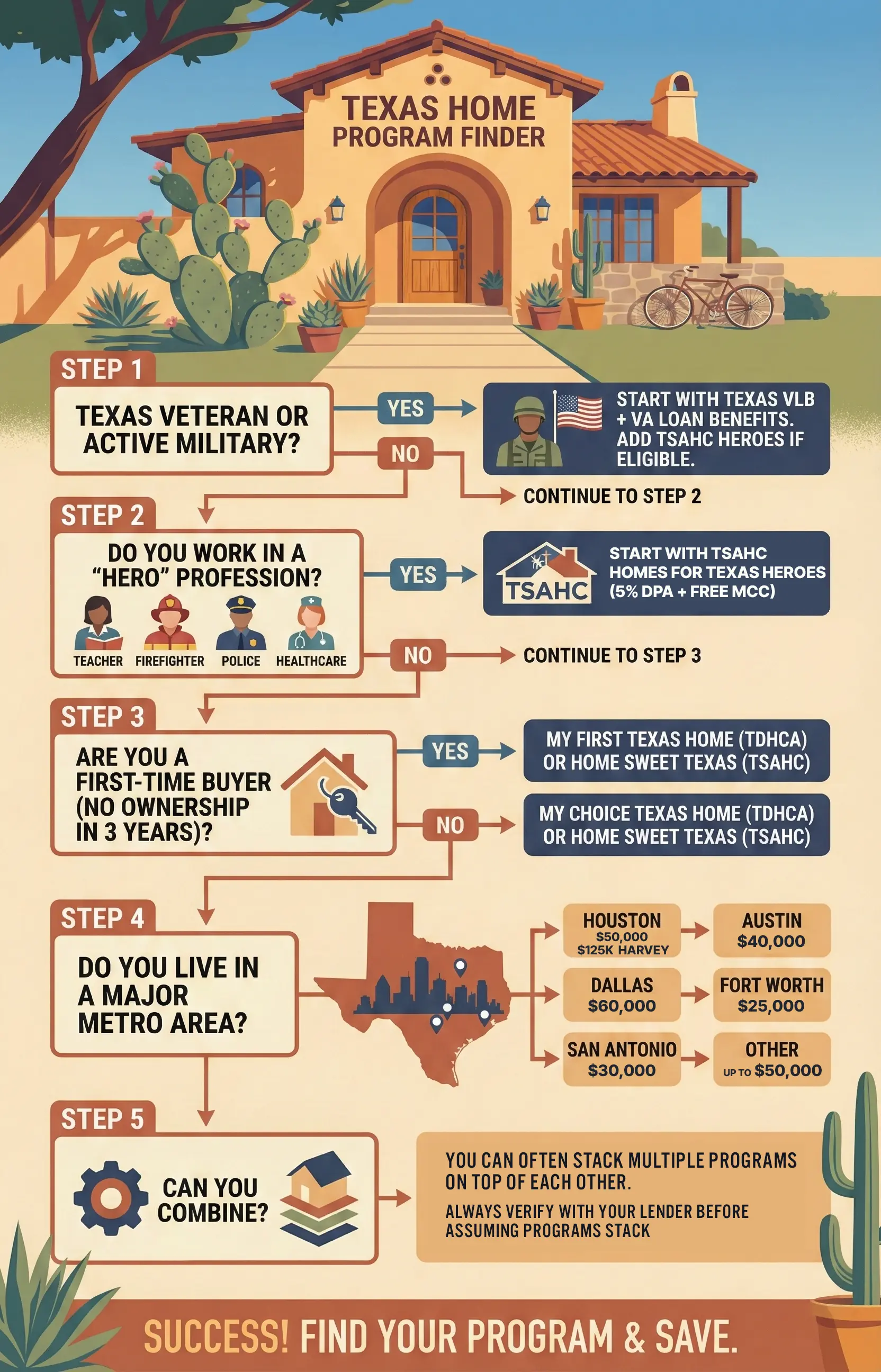

Eligibility Decision Framework: Which Program Is Right for You?

Use this decision tree to identify your best options:

🔍 Program Finder Decision Tree

- Step 1: Are you a Texas veteran or active military?

→ Yes: Start with Texas VLB + VA Loan benefits. Add TSAHC Heroes if eligible.

→ No: Continue to Step 2 - Step 2: Do you work in a "hero" profession?

→ Yes: TSAHC Homes for Texas Heroes (get free MCC)

→ No: Continue to Step 3 - Step 3: Are you a first-time buyer (no ownership in 3 years)?

→ Yes: My First Texas Home (TDHCA) OR Home Sweet Texas (TSAHC)

→ No: My Choice Texas Home (TDHCA) OR Home Sweet Texas (TSAHC) - Step 4: Do you live in a major metro area?

→ Houston: City of Houston HAP (up to $50,000)

→ Austin: City of Austin DPA (up to $40,000)

→ Dallas: DHAP (up to $60,000)

→ Fort Worth: HAP (up to $25,000)

→ San Antonio: HIP 80/120 (up to $30,000)

→ Other: Check local city/county programs - Step 5: Can you combine?

→ Check if city program allows layering with state program

→ Add MCC for additional annual tax savings

📋 Save this decision framework

Download our free 2-page cheat sheet with the program finder, income limits, and document checklist.

Get the Free Cheat Sheet →How to Apply: Step-by-Step Process

Step 1: Check Your Eligibility

- Take the TSAHC Eligibility Quiz (4 questions)

- Review income limits for your county and household size

- Confirm you meet credit score minimums (620+ for most programs)

Step 2: Complete Homebuyer Education

Every program requires HUD-approved homebuyer education. Options:

- Online: $0-$99 (eHome America, HomeView, Texas Homebuyer U)

- In-person: $0-$50 (check local providers)

Complete this BEFORE you start house hunting—you'll need the certificate to close.

Step 3: Find an Approved Lender

You MUST work with a program-approved lender. Find one through:

- TDHCA Lender Search

- TSAHC Lender Search

- City program websites

Step 4: Get Pre-Approved

Your lender will:

- Pull your credit

- Verify your income

- Determine which programs you qualify for

- Provide pre-approval letter

Need the full document checklist? Download our free cheat sheet with every document lenders require—W-2s, pay stubs, bank statements, and more.

Step 5: Find Your Home

- Work with any licensed REALTOR® (no restrictions)

- Home must be in Texas and meet program requirements

- Primary residence only—no investment properties

Step 6: Apply and Close

- Lender handles all DPA paperwork

- City programs may require additional inspections

- Typical timeline: 30-60 days from contract to closing

Common Mistakes to Avoid

🚫 7 Mistakes That Cost You Money

- Mistake #1: Not checking city programs first

- City programs often provide MORE assistance than state programs. Houston's $50,000 beats TDHCA's 5% on most homes.

- Mistake #2: Assuming you don't qualify

- Income limits are higher than most people think—often $85,000-$115,000 for a family of four.

- Mistake #3: Skipping homebuyer education

- You can't close without it. Complete it early to avoid delays.

- Mistake #4: Working with the wrong lender

- Only approved lenders can process DPA. Verify before you apply.

- Mistake #5: Missing the MCC opportunity

- The Mortgage Credit Certificate provides ongoing savings most buyers overlook. Ask about it.

- Mistake #6: Not comparing grant vs. forgivable loan

- Grant: Never repay, but slightly higher interest rate. Forgivable loan: Forgiven after 3 years if you stay in home.

- Mistake #7: Forgetting to budget for ongoing costs

- DPA helps with upfront costs, but you still need to afford the monthly payment. Use our Texas Mortgage Calculator to verify affordability.

⚡ Avoid these mistakes

Our free cheat sheet includes the 6-step action plan to help you avoid costly errors—plus the exact documents you'll need.

Get the Free Cheat Sheet →Texas Housing Market Outlook: Why 2026 Matters

The Texas housing market entering 2026 presents unique opportunities for first-time buyers:

📊 Current Market Conditions (December 2025)

- Median home price: ~$338,000 (down 1.4% year-over-year)

- Inventory: 4.8-5.5 months supply (approaching balanced market)

- Mortgage rates: Holding near 6.5-7%

- Days on market: 77-91 days (up from pandemic lows)

What this means for buyers:

- More negotiating power than 2021-2022

- Price reductions common (50%+ of Austin listings)

- Less competition, fewer bidding wars

- DPA programs stretch further with stabilizing prices

📅 Key Dates for 2026

- January: New income/price limits typically take effect

- Spring: Peak homebuying season begins

- Year-round: Check program funding status—some run out mid-year

FAQs: Texas First-Time Homebuyer Programs

What credit score do I need for Texas DPA programs?

Most programs require a minimum 620 credit score. Some FHA loans through these programs may accept 580, but options are limited. For manufactured homes, expect a 640 minimum.

Can I use DPA for a condo or townhome?

Yes, most programs allow single-family homes, condos, townhomes, and some allow manufactured homes with restrictions. The property must be your primary residence.

Do I have to repay down payment assistance?

It depends on the program type: Grants are never repaid. Forgivable loans are forgiven after 3-10 years if you stay in the home. Deferred loans are repaid when you sell, refinance, or move.

Can I combine multiple DPA programs?

Sometimes. You can often combine a state program with a city program, and add an MCC. However, you generally can't use two state-level DPA programs together. Check specific program rules.

What if I make too much money for DPA?

Income limits are county-specific and often higher than expected (around $85,000-$115,000 for a family of four in most areas). If you exceed limits, conventional loans with 3% down may be your best option.

Is there an income MINIMUM?

Most programs have no income minimum—you just need to qualify for a mortgage. Dallas's Anti-Displacement program is an exception, requiring at least 50% AMI.

Do these programs run out of money?

Yes, some city programs have limited funding. Apply early in the year when possible. State programs (TDHCA, TSAHC) are generally well-funded year-round.

Can veterans use both VLB and VA loan benefits?

Yes! Texas veterans can combine VLB home loans with federal VA loans to create a blended rate structure with potentially no down payment and no PMI.

What happens if I sell before the forgiveness period ends?

You'll typically repay a prorated portion of the assistance. For example, if you sell after 3 years of a 5-year forgivable loan, you might repay 40% of the original assistance.

Can non-US citizens qualify?

Permanent residents with valid Social Security numbers can qualify for most programs. Some programs also accept certain eligible immigration statuses. Undocumented residents generally do not qualify.

Next Steps: Start Your Texas Homebuying Journey

Ready to put these programs to work? Here's your action plan:

🎯 Your Action Plan

Today:

- Use our Texas Program Finder to discover which programs you qualify for (2-minute quiz)

- Use our Texas Mortgage Calculator to estimate your payment with DPA

- Take the TSAHC Eligibility Quiz to see which programs fit

This Week:

- Check your credit score (620+ opens most doors)

- Enroll in a homebuyer education course

This Month:

- Contact 2-3 approved lenders to compare options

- Get pre-approved and start house hunting

Your Texas First-Time Homebuyer Program Cheat Sheet

| If You Are... | Best Programs | Max Assistance |

|---|---|---|

| Teacher, first responder, veteran | TSAHC Homes for Texas Heroes + Free MCC | 5% + $2,000/yr tax credit |

| Texas veteran | VLB VHAP + VA Loan | $828,200 loan at low rates |

| Houston resident | City of Houston HAP | $50,000 |

| Austin resident | City of Austin DPA + TSAHC | $40,000 + 5% |

| Dallas resident | DHAP | $60,000 |

| Any first-time buyer | My First Texas Home (TDHCA) | 5% |

| Repeat buyer | My Choice Texas Home or Home Sweet Texas | 5% |

| Low income, willing to build | Texas Bootstrap Loan | $45,000 at 0% |

The Bottom Line: Texas offers some of the most generous first-time homebuyer assistance in the country. With the right combination of programs, you could receive $60,000 or more toward your home purchase—plus ongoing tax savings.

Don't leave this money on the table.

Ready to Find Your Programs?

Stop guessing which programs you qualify for. Take our interactive finder and get personalized recommendations in just 2 minutes.

Take the Quiz Now →📥 Get everything in one place

Download our free Texas 2026 First-Time Homebuyer Cheat Sheet—a 2-page PDF with the top 10 programs, income limits, document checklist, and 6-step action plan.

Get the Free Cheat Sheet →Tools to Plan Your Purchase

Helpful Resources

Official Texas DPA Program Links

- TSAHC Eligibility Quiz – See which programs you qualify for in 4 quick questions

- TDHCA Lender Search – Find approved lenders for My First Texas Home and other TDHCA programs

- TSAHC Lender Search – Find approved lenders for Homes for Texas Heroes and Home Sweet Texas

- TSAHC Official Website – Texas State Affordable Housing Corporation program details and updates

CalcLogix Guides

- Mortgage Rates Today – Check current rates to use in your calculations

- Mortgage Rates Guide – Understand rate types, APR vs interest rate, and how to get the best deal

- How Amortization Works – See how your mortgage payments break down over time

- Housing Inventory Trends – Track market conditions to time your purchase strategically

About Jon Teera

Jon Teera is the Lead Developer and Founder of CalcLogix. Unlike traditional financial writers, Jon approaches personal finance as a data engineering problem. He built this resource to be the single most comprehensive database of Texas DPA programs available, helping first-time buyers maximize their benefits and navigate the complex DPA landscape with confidence.

Read more about how we verify data →